Form Ur-50 - Notice To Assessor

ADVERTISEMENT

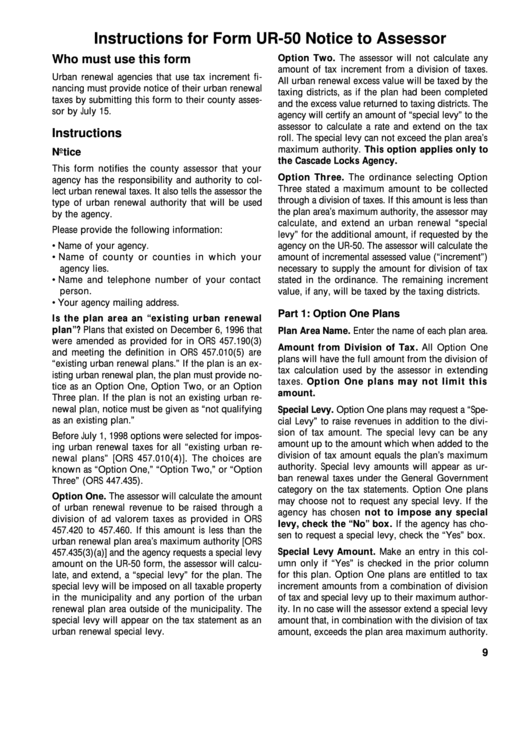

Instructions for Form UR-50 Notice to Assessor

Who must use this form

Option Two. The assessor will not calculate any

amount of tax increment from a division of taxes.

Urban renewal agencies that use tax increment fi-

All urban renewal excess value will be taxed by the

nancing must provide notice of their urban renewal

taxing districts, as if the plan had been completed

taxes by submitting this form to their county asses-

and the excess value returned to taxing districts. The

sor by July 15.

agency will certify an amount of “special levy” to the

assessor to calculate a rate and extend on the tax

Instructions

roll. The special levy can not exceed the plan area’s

maximum authority. This option applies only to

Notice

the Cascade Locks Agency.

This form notifies the county assessor that your

Option Three. The ordinance selecting Option

agency has the responsibility and authority to col-

Three stated a maximum amount to be collected

lect urban renewal taxes. It also tells the assessor the

through a division of taxes. If this amount is less than

type of urban renewal authority that will be used

the plan area’s maximum authority, the assessor may

by the agency.

calculate, and extend an urban renewal “special

Please provide the following information:

levy” for the additional amount, if requested by the

• Name of your agency.

agency on the UR-50. The assessor will calculate the

• Name of county or counties in which your

amount of incremental assessed value (“increment”)

agency lies.

necessary to supply the amount for division of tax

• Name and telephone number of your contact

stated in the ordinance. The remaining increment

person.

value, if any, will be taxed by the taxing districts.

• Your agency mailing address.

Part 1: Option One Plans

Is the plan area an “existing urban renewal

plan”? Plans that existed on December 6, 1996 that

Plan Area Name. Enter the name of each plan area.

were amended as provided for in ORS 457.190(3)

Amount from Division of Tax. All Option One

and meeting the definition in ORS 457.010(5) are

plans will have the full amount from the division of

“existing urban renewal plans.” If the plan is an ex-

tax calculation used by the assessor in extending

isting urban renewal plan, the plan must provide no-

taxes. Option One plans may not limit this

tice as an Option One, Option Two, or an Option

amount.

Three plan. If the plan is not an existing urban re-

newal plan, notice must be given as “not qualifying

Special Levy. Option One plans may request a “Spe-

as an existing plan.”

cial Levy” to raise revenues in addition to the divi-

sion of tax amount. The special levy can be any

Before July 1, 1998 options were selected for impos-

amount up to the amount which when added to the

ing urban renewal taxes for all “existing urban re-

division of tax amount equals the plan’s maximum

newal plans” [ORS 457.010(4)]. The choices are

authority. Special levy amounts will appear as ur-

known as “Option One,” “Option Two,” or “Option

ban renewal taxes under the General Government

Three” (ORS 447.435).

category on the tax statements. Option One plans

Option One. The assessor will calculate the amount

may choose not to request any special levy. If the

of urban renewal revenue to be raised through a

agency has chosen not to impose any special

division of ad valorem taxes as provided in ORS

levy, check the “No” box. If the agency has cho-

457.420 to 457.460. If this amount is less than the

sen to request a special levy, check the “Yes” box.

urban renewal plan area’s maximum authority [ORS

Special Levy Amount. Make an entry in this col-

457.435(3)(a)] and the agency requests a special levy

umn only if “Yes” is checked in the prior column

amount on the UR-50 form, the assessor will calcu-

for this plan. Option One plans are entitled to tax

late, and extend, a “special levy” for the plan. The

increment amounts from a combination of division

special levy will be imposed on all taxable property

in the municipality and any portion of the urban

of tax and special levy up to their maximum author-

renewal plan area outside of the municipality. The

ity. In no case will the assessor extend a special levy

special levy will appear on the tax statement as an

amount that, in combination with the division of tax

urban renewal special levy.

amount, exceeds the plan area maximum authority.

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3