Clear This Page

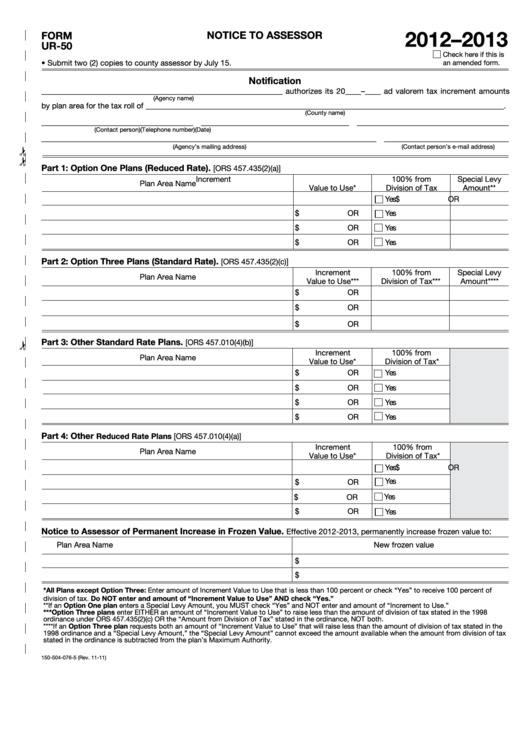

2012–2013

FORM

NOTICE TO ASSESSOR

UR-50

Check here if this is

• Submit two (2) copies to county assessor by July 15.

an amended form.

Notification

_____________________________________________________________ authorizes its 20____–____ ad valorem tax increment amounts

(Agency name)

by plan area for the tax roll of ____________________________________________________________________________________________.

(County name)

_______________________________________ ______________________________________ _______________________________________

(Contact person)

(Telephone number)

(Date)

______________________________________________________________________________________ ________________________________

(Agency’s mailing address)

(Contact person’s e-mail address)

Part 1: Option One Plans (Reduced Rate).

[ORS 457.435(2)(a)]

Increment

100% from

Special Levy

Plan Area Name

Value to Use*

Division of Tax

Amount**

$

OR

Yes

$

OR

Yes

$

OR

Yes

$

OR

Yes

Part 2: Option Three Plans (Standard Rate).

[ORS 457.435(2)(c)]

Increment

100% from

Special Levy

Plan Area Name

Value to Use***

Division of Tax***

Amount****

$

OR

$

OR

$

OR

Part 3: Other Standard Rate Plans.

[ORS 457.010(4)(b)]

Increment

100% from

Plan Area Name

Value to Use*

Division of Tax*

$

OR

Yes

Yes

$

OR

$

OR

Yes

$

OR

Yes

Part 4: Other

Reduced Rate Plans [ORS 457.010(4)(a)]

Increment

100% from

Plan Area Name

Value to Use*

Division of Tax*

$

OR

Yes

Yes

$

OR

Yes

$

OR

$

OR

Yes

Notice to Assessor of Permanent Increase in Frozen Value.

:

Effective 2012-2013, permanently increase frozen value to

Plan Area Name

New frozen value

$

$

*All Plans except Option Three: Enter amount of Increment Value to Use that is less than 100 percent or check “Yes” to receive 100 percent of

division of tax. Do NOT enter and amount of “Increment Value to Use” AND check “Yes.”

**If an Option One plan enters a Special Levy Amount, you MUST check “Yes” and NOT enter and amount of “Increment to Use.”

***Option Three plans enter EITHER an amount of “Increment Value to Use” to raise less than the amount of division of tax stated in the 1998

ordinance under ORS 457.435(2)(c) OR the “Amount from Division of Tax” stated in the ordinance, NOT both.

****If an Option Three plan requests both an amount of “Increment Value to Use” that will raise less than the amount of division of tax stated in the

1998 ordinance and a “Special Levy Amount,” the “Special Levy Amount” cannot exceed the amount available when the amount from division of tax

stated in the ordinance is subtracted from the plan’s Maximum Authority.

150-504-076-5 (Rev. 11-11)

1

1