Form Cu-7 - Virginia Consumer'S Use Tax Return For Individuals Worksheet

ADVERTISEMENT

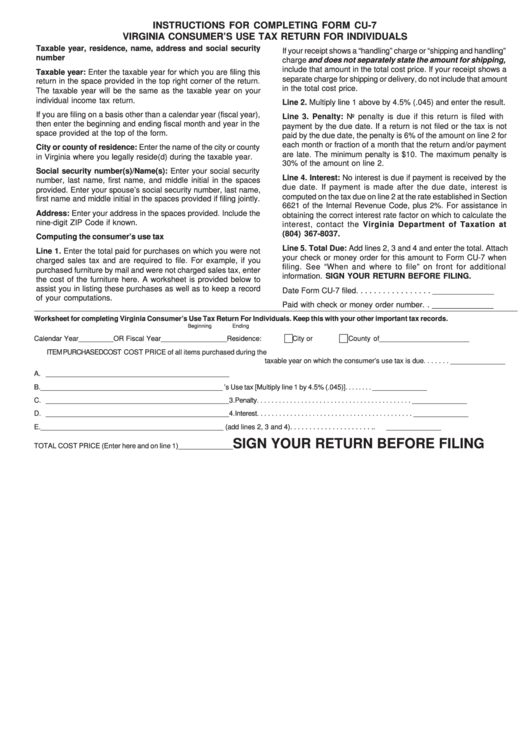

INSTRUCTIONS FOR COMPLETING FORM CU-7

VIRGINIA CONSUMER’S USE TAX RETURN FOR INDIVIDUALS

Taxable year, residence, name, address and social security

If your receipt shows a “handling” charge or “shipping and handling”

number

charge and does not separately state the amount for shipping,

include that amount in the total cost price. If your receipt shows a

Taxable year: Enter the taxable year for which you are filing this

separate charge for shipping or delivery, do not include that amount

return in the space provided in the top right corner of the return.

in the total cost price.

The taxable year will be the same as the taxable year on your

individual income tax return.

Line 2. Multiply line 1 above by 4.5% (.045) and enter the result.

If you are filing on a basis other than a calendar year (fiscal year),

Line 3. Penalty: No penalty is due if this return is filed with

then enter the beginning and ending fiscal month and year in the

payment by the due date. If a return is not filed or the tax is not

space provided at the top of the form.

paid by the due date, the penalty is 6% of the amount on line 2 for

each month or fraction of a month that the return and/or payment

City or county of residence: Enter the name of the city or county

are late. The minimum penalty is $10. The maximum penalty is

in Virginia where you legally reside(d) during the taxable year.

30% of the amount on line 2.

Social security number(s)/Name(s): Enter your social security

Line 4. Interest: No interest is due if payment is received by the

number, last name, first name, and middle initial in the spaces

due date. If payment is made after the due date, interest is

provided. Enter your spouse’s social security number, last name,

computed on the tax due on line 2 at the rate established in Section

first name and middle initial in the spaces provided if filing jointly.

6621 of the Internal Revenue Code, plus 2%. For assistance in

Address: Enter your address in the spaces provided. Include the

obtaining the correct interest rate factor on which to calculate the

nine-digit ZIP Code if known.

interest, contact the Virginia Department of Taxation at

(804) 367-8037.

Computing the consumer’s use tax

Line 5. Total Due: Add lines 2, 3 and 4 and enter the total. Attach

Line 1. Enter the total paid for purchases on which you were not

your check or money order for this amount to Form CU-7 when

charged sales tax and are required to file. For example, if you

filing. See “When and where to file” on front for additional

purchased furniture by mail and were not charged sales tax, enter

information. SIGN YOUR RETURN BEFORE FILING.

the cost of the furniture here. A worksheet is provided below to

assist you in listing these purchases as well as to keep a record

Date Form CU-7 filed . . . . . . . . . . . . . . . . .

______________

of your computations.

Paid with check or money order number . .

______________

Worksheet for completing Virginia Consumer’s Use Tax Return For Individuals. Keep this with your other important tax records.

Beginning

Ending

Calendar Year

_________ OR Fiscal Year

________

_________

Residence:

City or

County of_______________________

ITEM PURCHASED

COST PRICE

1. TOTAL COST PRICE of all items purchased during the

taxable year on which the consumer’s use tax is due . . . . . . .

______________

A. _________________________________

______________

B. _________________________________

______________

2. Consumer’s Use tax [Multiply line 1 by 4.5% (.045)] . . . . . . . .

_________ _____

C. _________________________________

______________

3. Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________

D. _________________________________

______________

4. Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________

E. _________________________________

______________

5. Total Due (add lines 2, 3 and 4) . . . . . . . . . . . . . . . . . . . . . . .

______________

SIGN YOUR RETURN BEFORE FILING

TOTAL COST PRICE (Enter here and on line 1)

______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1