Work Sheet For Completing Virginia Consumer'S Use Tax Return For Individuals (Cu-7)

ADVERTISEMENT

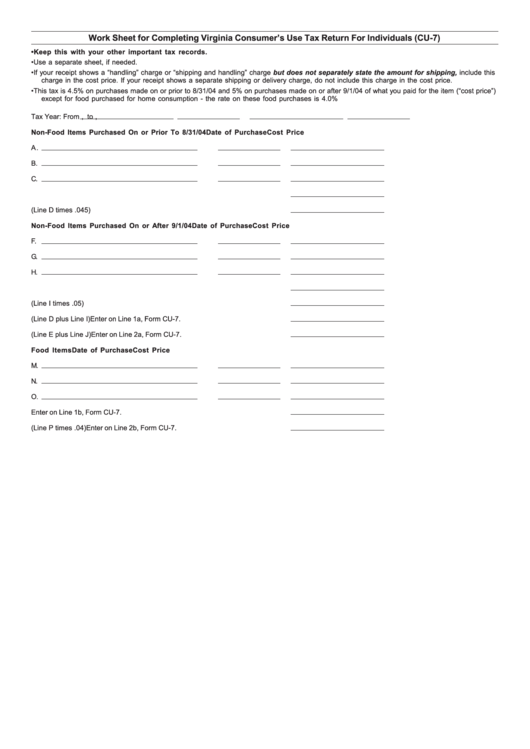

Work Sheet for Completing Virginia Consumer’s Use Tax Return For Individuals (CU-7)

•

Keep this with your other important tax records.

•

Use a separate sheet, if needed.

•

If your receipt shows a “handling” charge or “shipping and handling” charge but does not separately state the amount for shipping, include this

charge in the cost price. If your receipt shows a separate shipping or delivery charge, do not include this charge in the cost price.

•

This tax is 4.5% on purchases made on or prior to 8/31/04 and 5% on purchases made on or after 9/1/04 of what you paid for the item (“cost price”)

except for food purchased for home consumption - the rate on these food purchases is 4.0%

Tax Year: From

,

to

,

Non-Food Items Purchased On or Prior To 8/31/04

Date of Purchase

Cost Price

A.

B.

C.

D. Total Cost of Non-Food Items Purchased On or Prior to 8/31/04

E. Tax on Non-Food Items Purchased On or Prior to 8/31/04 (Line D times .045)

Non-Food Items Purchased On or After 9/1/04

Date of Purchase

Cost Price

F.

G.

H.

I. Total Cost of Non-Food Items Purchased On or After 9/1/04

J. Tax on Non-Food Items Purchased On or After 9/1/04 (Line I times .05)

K. Grand Total of Cost of Non-Food Items Purchased (Line D plus Line I)

Enter on Line 1a, Form CU-7.

L. Total Tax on Non-Food Items Purchased (Line E plus Line J)

Enter on Line 2a, Form CU-7.

Food Items

Date of Purchase

Cost Price

M.

N.

O.

P. Total Cost of Food Items Purchased

Enter on Line 1b, Form CU-7.

Q. Tax on Food Items Purchased (Line P times .04)

Enter on Line 2b, Form CU-7.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1