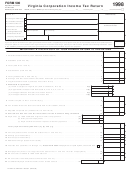

Form 500 - Virginia Corporation Income Tax Return - 2003 Page 2

ADVERTISEMENT

PART I — Additions to Federal Taxable Income (attach schedules):

Page 2

22 Net income taxes and other taxes which are based on, measured by or computed with

reference to net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Interest on state obligations other than Virginia . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Savings and loan associationís federal bad debt deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Unrelated business taxable income as defined by Section 512 of the IRC (to the extent

excluded from Line 1, Page 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 The amount of ESOP Credit carryover deducted under Section 404(i) of the IRC . . . . . . . . . . . . . . . . 26

27 Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

w

28 Total - Enter this amount on line 2(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

PART II — Subtractions from Federal Taxable Income (attach schedules):

29 Income from obligations or securities of the United States exempt from state

income taxes but not from federal income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

30 Foreign dividend gross-up (Section 78 IRC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

31 Refund or credit of income taxes included in federal taxable income . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 Subpart F income (Section 951 IRC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

33 The amount of salaries and wages not deducted due to the federal work opportunity tax credit . . . . . 33

34 Foreign source income as defined by Virginia Code Section 58.1-402 C.8.

(see instructions for limitations) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

35 Dividends received from corporations in which the recipient owns fifty percent or more

of the voting stock and to the extent remaining in federal taxable income . . . . . . . . . . . . . . . . . . . . . . 35

36 Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

w

37 Total - Enter this amount on line 4(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

PART III — Questions

38 The corporation's books are in care of

, located at

_______________________________________________

______________________________________________

Telephone Number

.

____________________________________________

39 Check if the corporation is a farmers' marketing or a farmers' purchasing cooperative association

, a consumers'

_________________

cooperative association

, or other cooperative association

.

_____________________

_______________________

40 If a net operating loss deduction (NOL) was claimed in computing federal taxable income on the U.S. Corporation Income Tax

Return, complete the following information:

w

Year of loss . . . . . . . . . . . . . . . . . . . . . . .

Federal NOL . . . . . . . . . . . . . . . . . . . . . . . .

____________________

____________________

w

Net Va. Modifications for year of NOL . . .

Percent of federal NOL utilized this year . .

____________________

____________________

If NOL's from more than one loss year are involved, attach a schedule.

41 Has your federal income tax liability been redetermined for any prior year(s) which has not previously been reported to the

w

Virginia Department of Taxation? Yes

No

. If "yes," state years

. Report

____________

___________

_____________________________________________

changes under separate cover and mail to Virginia Department of Taxation, P.O. Box 1500, Richmond, Virginia 23218-1500.

Mail this return to the Virginia Department of Taxation, P. O. Box 1500, Richmond, Virginia 23218-1500 on or before the fifteenth day

of the fourth month (15th day of the sixth month for nonprofit corporations) following the close of the taxable year. Make checks

payable to the Virginia Department of Taxation.

DECLARATION

I, the undersigned president, vice-president, treasurer, assistant treasurer, chief accounting officer, or other officer duly authorized to act, of the corporation for which this

return is made, declare under the penalties provided by law that this return (including any accompanying schedules and statements) has been examined by me and is, to the

best of my knowledge and belief, a true, correct, and complete return, made in good faith, for the taxable year stated, pursuant to the income tax laws of the Commonwealth

of Virginia. If prepared by a person other than taxpayer, their declaration is based on all information of which they have any knowledge.

____________________

_____________________________________________________________________________________________

_____________________________________

(Date)

(Signature of officer)

(Title)

____________________

_____________________________________________________________________________________________

_____________________________________

(Date)

(Individual or firm, signature of preparer, and phone number)

(Address)

Preparer's SSN or FEIN

If this form was computer generated, check this box.

Certified Vendor ID

, , , , , REMEMBER , , , , , If you are filing a tax due return, Form 500V MUST be attached

unless payment is made by Electronic Funds Transfer (EFT).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2