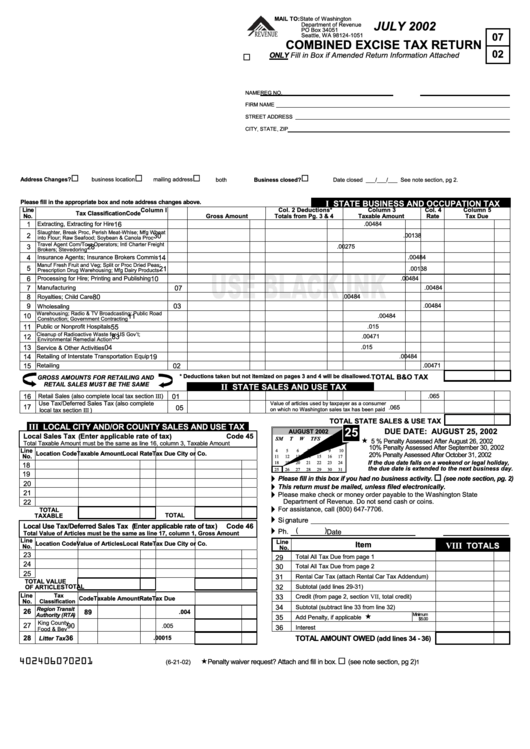

Form O7 - Combined Excise Tax Return - 2002

ADVERTISEMENT

MAIL TO: State of Washington

JULY 2002

Department of Revenue

PO Box 34051

07

Seattle, WA 98124-1051

COMBINED EXCISE TAX RETURN

02

ONLY Fill in Box if Amended Return Information Attached

"

NAME

REG NO.

FIRM NAME

STREET ADDRESS

CITY, STATE, ZIP

"

"

"

"

Address Changes?

business location

mailing address

both

Business closed?

Date closed ___/___/___ See note section, pg 2.

Please fill in the appropriate box and note address changes above.

I STATE BUSINESS AND OCCUPATION TAX

Line

Column I

Col. 2 Deductions*

Column 3

Col. 4

Column 5

Tax Classification

Code

No.

Gross Amount

Totals from Pg. 3 & 4

Taxable Amount

Rate

Tax Due

1

16

Extracting, Extracting for Hire

.00484

Slaughter, Break Proc, Perish Meat-Whlse; Mfg Wheat

2

30

.00138

into Flour; Raw Seafood; Soybean & Canola Proc

Travel Agent Com/Tour Operators; Intl Charter Freight

3

28

.00275

Brokers; Stevedoring

4

Insurance Agents; Insurance Brokers Commis

14

.00484

Manuf Fresh Fruit and Veg; Split or Proc Dried Peas;

5

21

.00138

Prescription Drug Warehousing; Mfg Dairy Products

6

Processing for Hire; Printing and Publishing

10

.00484

7

Manufacturing

07

.00484

8

80

.00484

Royalties; Child Care

9

03

.00484

Wholesaling

Warehousing; Radio & TV Broadcasting; Public Road

10

11

.00484

Construction; Government Contracting

11

Public or Nonprofit Hospitals

55

.015

Cleanup of Radioactive Waste for US Gov’t;

12

83

.00471

Environmental Remedial Action

13

04

.015

Service & Other Activities

14

Retailing of Interstate Transportation Equip

19

.00484

15

Retailing

02

.00471

* Deductions taken but not itemized on pages 3 and 4 will be disallowed.

TOTAL B&O TAX

GROSS AMOUNTS FOR RETAILING AND

RETAIL SALES MUST BE THE SAME

II STATE SALES AND USE TAX

Retail Sales (also complete local tax section III)

16

01

.065

Use Tax/Deferred Sales Tax (also complete

Value of articles used by taxpayer as a consumer

17

05

.065

on which no Washington sales tax has been paid

local tax section III)

TOTAL STATE SALES & USE TAX

III LOCAL CITY AND/OR COUNTY SALES AND USE TAX

25

DUE DATE: AUGUST 25, 2002

AUGUST 2002

Local Sales Tax (Enter applicable rate of tax)

Code 45

S

M

T

W

T

F

S

!

5 % Penalty Assessed After August 26, 2002

Total Taxable Amount must be the same as line 16, column 3, Taxable Amount

1

2

3

10% Penalty Assessed After September 30, 2002

Line

4

5

6

7

8

9

10

No. Location Code

Taxable Amount

Local Rate

Tax Due City or Co.

20% Penalty Assessed After October 31, 2002

11

12

13

14

15

16

17

If the due date falls on a weekend or legal holiday,

18

19

20

21

22

23

24

18

the due date is extended to the next business day.

25

26

27

28

29

30

31

19

#

4

Please fill in this box if you had no business activity.

(see note section, pg. 2)

20

4

This return must be mailed, unless filed electronically.

21

4

Please make check or money order payable to the Washington State

Department of Revenue. Do not send cash or coins.

22

4

For assistance, call (800) 647-7706.

TOTAL

TOTAL

TAXABLE

4

Signature

Local Use Tax/Deferred Sales Tax (Enter applicable rate of tax)

Code 46

Ph. (

)

4

Date

Total Value of Articles must be the same as line 17, column 1, Gross Amount

Line

Line

No. Location Code

Value of Articles

Local Rate Tax Due City or Co.

Item

VIII TOTALS

No.

23

29

Total All Tax Due from page 1

24

30

Total All Tax Due from page 2

25

31

Rental Car Tax (attach Rental Car Tax Addendum)

TOTAL VALUE

TOTAL

OF ARTICLES

32

Subtotal (add lines 29-31)

Line

Tax

33

Credit (from page 2, section VII, total credit)

Code

Taxable Amount

Rate

Tax Due

No.

Classification

34

Subtotal (subtract line 33 from line 32)

Region Transit

26

89

.004

Authority (RTA)

!

Minimum

35

Add Penalty, if applicable

$5.00

King County

27

90

.005

36

Interest

Food & Bev

28

36

TOTAL AMOUNT OWED

(add lines 34 - 36)

Litter Tax

.00015

402406070201

"

!

Penalty waiver request? Attach and fill in box.

(see note section, pg 2)

(6-21-02)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5