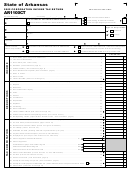

Form O7 - Combined Excise Tax Return - 2002 Page 2

ADVERTISEMENT

IV LODGING TAXES

TRANSIENT RENTAL INCOME INFORMATION

(enter location code and income only)

Code 47

Line

Location Code

Income

Location Code

Income

Location Code

Income

No.

37

38

CONVENTION AND TRADE CENTER TAX

SPECIAL HOTEL/MOTEL TAX

Code 48

Code 70

Line

Line

Location Code

Taxable Amount

Rate

Tax Due

Location Code

Taxable Amount

Rate

Tax Due

No.

No.

39

42

40

43

41

44

TOTAL CONVENTION & TRADE CENTER TAX

TOTAL SPECIAL HOTEL/MOTEL TAX

V STATE PUBLIC UTILITY TAX

Line

Column I

Col. 2 Deductions*

Column 3**

Col. 4

Column 5

Tax Classification

Code

No.

Gross Amount

Totals from Pg. 4

Taxable Amount

Rate

Tax Due

45

60

Water Distribution

.05029

46

Sewer Collection

61

.03852

47

49

Power

.03873

48

Gas Distribution; Telegraph

26

.03852

49

08

Motor Transportation; Railroad; Railroad Car

.01926

50

Urban Transportation; Vessels Under 65 ft

12

.00642

51

Other Public Service Business

13

.01926

** If taxable amounts on lines 45-51 column 3 total less than $2,000, no Public Utility Tax is due.

TOTAL STATE PUBLIC UTILITY TAX

VI OTHER TAXES

Line

Column I

Col. 2 Deductions*

Column 3

Col. 4

Column 5

Tax Classification

Code

No.

Gross Amount

Totals from Pg. 4

Taxable Amount

Rate

Tax Due

52

Tobacco Products

20

1.2942

53

Refuse Collection

64

.036

54

57

Temporarily Not Due - Fund Limit Reached

Petroleum Tax

.005

55

65

Hazardous Substance

.007

Intermediate Care Facilities for the

56

79

.06

Mentally Retarded (IMR)

* Deductions taken but not itemized on page 4 will be disallowed.

Line

Tax Classification

Code

Item

Quantity Sold

Rate

Tax Due

No.

Number of Stoves, Fireplaces, & Solid

57

Solid Fuel Burning Device Fee

59

$30.00

Fuel Burning Devices:

Number of Gallons

58

Syrup Tax

54

$1.00

(whole numbers only):

59

State Enhanced 911 Tax

93

Number of Taxable Switched Access Lines:

.20

TOTAL OTHER TAXES

PLEASE NOTE:

(Add lines 52-59)

If you do not have deductions, do not return pages 3 and 4.

If you have deductions, complete and return pages 3 and 4.

VII CREDITS

NEED HELP?

Line

Credit

Credit Classification

Amount

No.

I.D.

Internet Assistance – Go to DOR’s home page at

•

Click on FORMS to access forms including the Local City and/or

60

800

Multiple Activities Tax Credit (attach Schedule C)

County Sales and Use Tax Supplement, and other tax-related forms.

High Technology Credit

•

Under Tax Topics, click on BUSINESS for answers to frequently

61

830

(attach Research & Development Credit Affidavit)

asked questions and business closure information. Under

Manufacturing Software; Programming Rural Employment

PUBLICATIONS, the Business Tax Guide link provides tax

62

860

B&O Credit

return information and instructions, and the Filing Your Tax

Return link provides penalty waiver information.

63

865

Help Desk Services B&O Credit

•

To update your account information or to close your account with

64

875

Alternatives to Field Burning B&O Credit

the Department of Revenue, click on DOR SERVICES, then

Business Information Update.

65

855

International Services Credit

Telephone Assistance

66

815

Small Business B&O Tax Credit (see table enclosed)

•

Call the Department of Revenue office nearest you or (800) 647-7706.

•

To file a No Business Activity return by telephone, call (800) 647-7706.

Electric Utility Rural Economic Development Revolving Fund

67

870

Enter code 111 and follow these steps: 1) Enter your 9-digit

Public Utility Tax Credit

registration number; 2) Verify the number entered; 3) Enter 3;

68

801

Bad Debt Tax Credit (attach Schedule B)

4) Respond to pre-recorded questions to file your return over the

telephone. Do not mail paper return back to the department.

69

805

Hazardous Substance

•

For penalty waiver criteria information, call (800) 334-8969 and

enter code 429.

Public Utility Tax Credit for Billing Discounts/Qualified Contributions

70

880

to a Low Income Home Energy Assistance Fund

•

For business closure information, call (800) 334-8969 and

enter code 430.

71

810

Other Credits (attach appropriate documents)

For tax assistance, visit or call (800) 647-7706.

To inquire about the availability of this document in an alternate

TOTAL CREDIT (transfer to page 1, line 33)

format for the visually impaired, please call (360) 486-2342.

Teletype (TTY) users may call (800) 451-7985.

402406070202

(6-21-02)

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5