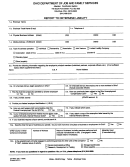

Ohio Department of Job and Family Services

REPORT TO DETERMINE LIABILITY

TRANSFER OF BUSINESS BETWEEN COMMON OWNERS

Attention: Contribution Section

P.O. Box 182404

Columbus, Ohio 43218-2404

(614) 466-2319 extension 22485

The Ohio Unemployment Compensation Law requires that if part of a trade or business transfers between employers who

are under “substantially common ownership, management, or control,” then the unemployment experience attributable to

the transferred portion must be transferred to the acquiring employer(s). The transferred experience will be used in

determining the acquiring employer’s subsequent contribution rates.

1. Did you acquire a portion (less than 100%) of a trade or business from an employer with which your business has common

ownership, management, or control?

Yes

No

If yes, you must complete items 2 through 7.

2.

Transferor’s Name

Transferor’s Current Address

Transferor’s ODJFS Account Number

Transferor’s Telephone Number

Acquiring Employer’s Name

Acquiring Employer’s Current Address

Acquiring Employer’s ODJFS Account Number

Acquiring Employer’s Telephone Number

3.

Provide the address, location, and a description of the transferred portion as it existed before the transfer

4. Provide the date of the transfer

5. Provide the date of first employment subject to the Ohio Unemployment Compensation Law for the transferred portion before it

was transferred

6. Provide the gross and taxable payroll totals attributable to the transferred portion for the four calendar quarters immediately

preceding the quarter in which the transfer occurred:

Quarter/Year

Gross Wages

Taxable Wages

7. Provide on a separate sheet the names and social security numbers of the employees transferred. If more than 20 employees

transferred, please provide this information via CD or other electronic media.

I hereby certify that the information given above is true and correct to the best of my knowledge and belief:

Signature

Title

Date

Please See Reverse Side for More Information

JFS 66302 (4/2010)

Page 3 of 4

1

1 2

2