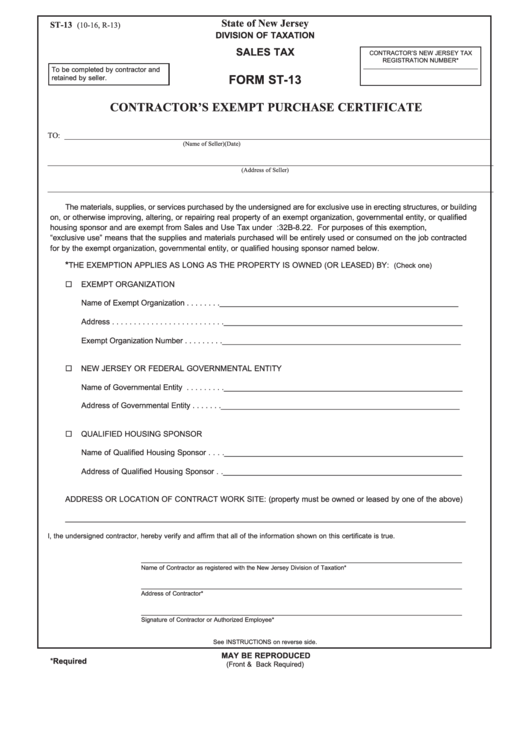

State of New Jersey

ST-13

(10-16, R-13)

DIVISION OF TAXATION

SALES TAX

CONTRACTOR’S NEW JERSEY TAX

REGISTRATION NUMBER*

To be completed by contractor and

FORM ST-13

retained by seller.

CONTRACTOR’S EXEMPT PURCHASE CERTIFICATE

TO: ________________________________________________________________________________ __________________________

(Name of Seller)

(Date)

_______________________________________________________________________________________________________________

(Address of Seller)

_______________________________________________________________________________________________________________

The materials, supplies, or services purchased by the undersigned are for exclusive use in erecting structures, or building

on, or otherwise improving, altering, or repairing real property of an exempt organization, governmental entity, or qualified

housing sponsor and are exempt from Sales and Use Tax under N.J.S.A. 54:32B-8.22. For purposes of this exemption,

“exclusive use” means that the supplies and materials purchased will be entirely used or consumed on the job contracted

for by the exempt organization, governmental entity, or qualified housing sponsor named below.

*

THE EXEMPTION APPLIES AS LONG AS THE PROPERTY IS OWNED (OR LEASED) BY:

(Check one)

¨

EXEMPT ORGANIZATION

Name of Exempt Organization . . . . . . . . ________________________________________________________

Address . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________________________________________

Exempt Organization Number . . . . . . . . . ________________________________________________________

¨

NEW JERSEY OR FEDERAL GOVERNMENTAL ENTITY

Name of Governmental Entity . . . . . . . . . ________________________________________________________

Address of Governmental Entity . . . . . . . ________________________________________________________

¨

QUALIFIED HOUSING SPONSOR

Name of Qualified Housing Sponsor . . . . ________________________________________________________

Address of Qualified Housing Sponsor . . ________________________________________________________

ADDRESS OR LOCATION OF CONTRACT WORK SITE: (property must be owned or leased by one of the above)

______________________________________________________________________________________________

I, the undersigned contractor, hereby verify and affirm that all of the information shown on this certificate is true.

_____________________________________________________________________________________

Name of Contractor as registered with the New Jersey Division of Taxation*

_____________________________________________________________________________________

Address of Contractor*

_____________________________________________________________________________________

Signature of Contractor or Authorized Employee*

See INSTRUCTIONS on reverse side.

MAY BE REPRODUCED

*Required

(Front & Back Required)

1

1 2

2