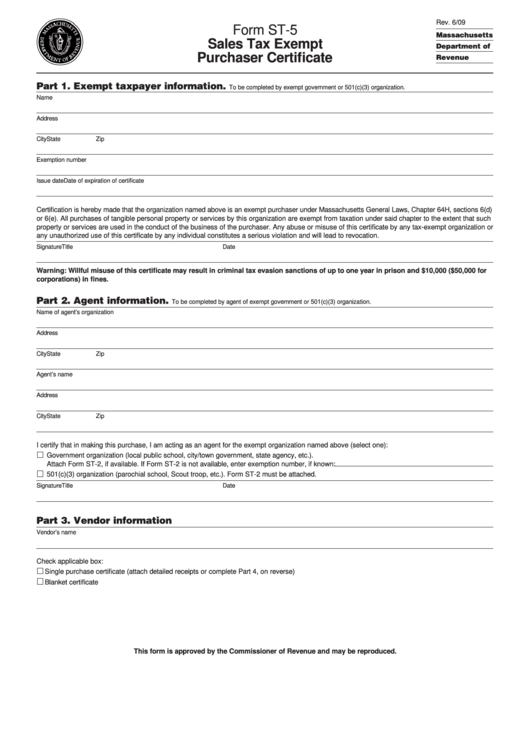

Rev. 6/09

Form ST-5

Massachusetts

Sales Tax Exempt

Department of

Purchaser Certificate

Revenue

Part 1. Exempt taxpayer information.

To be completed by exempt government or 501(c)(3) organization.

Name

Address

City

State

Zip

Exemption number

Issue date

Date of expiration of certificate

Certification is hereby made that the organization named above is an exempt purchaser under Massachusetts General Laws, Chapter 64H, sections 6(d)

or 6(e). All purchases of tangible personal property or services by this organization are exempt from taxation under said chapter to the extent that such

property or services are used in the conduct of the business of the purchaser. Any abuse or misuse of this certificate by any tax-exempt organization or

any unauthorized use of this certificate by any individual constitutes a serious violation and will lead to revocation.

Signature

Title

Date

Warning: Willful misuse of this certificate may result in criminal tax evasion sanctions of up to one year in prison and $10,000 ($50,000 for

corporations) in fines.

Part 2. Agent information.

To be completed by agent of exempt government or 501(c)(3) organization.

Name of agent’s organization

Address

City

State

Zip

Agent’s name

Address

City

State

Zip

I certify that in making this purchase, I am acting as an agent for the exempt organization named above (select one):

Government organization (local public school, city/town government, state agency, etc.).

Attach Form ST-2, if available. If Form ST-2 is not available, enter exemption number, if known:

501(c)(3) organization (parochial school, Scout troop, etc.). Form ST-2 must be attached.

Signature

Title

Date

Part 3. Vendor information

Vendor’s name

Check applicable box:

Single purchase certificate (attach detailed receipts or complete Part 4, on reverse)

Blanket certificate

This form is approved by the Commissioner of Revenue and may be reproduced.

1

1 2

2