Simplified Method Worksheet For Business Use Of The Home

ADVERTISEMENT

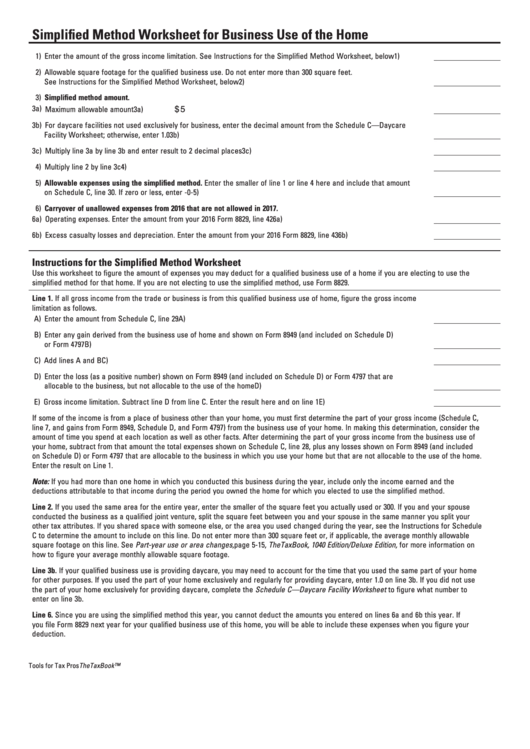

Simplified Method Worksheet for Business Use of the Home

1) Enter the amount of the gross income limitation. See Instructions for the Simplified Method Worksheet, below

1)

.. . .. .. . .. .. . .

2) Allowable square footage for the qualified business use. Do not enter more than 300 square feet.

See Instructions for the Simplified Method Worksheet, below

2)

.. ..... ..... .... ... . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .

3) Simplified method amount.

$ 5

3a) Maximum allowable amount

3a)

............................................... ..... .... ..... ..... .... .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. ..

3b) For daycare facilities not used exclusively for business, enter the decimal amount from the Schedule C—Daycare

Facility Worksheet; otherwise, enter 1.0

3b)

............................. ..... .... ..... ..... .... .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. ..

3c) Multiply line 3a by line 3b and enter result to 2 decimal places

3c)

.. .... ..... .... .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. ..

4) Multiply line 2 by line 3c

4)

...................................................... ..... .... ..... ..... .... .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .

5) Allowable expenses using the simplified method. Enter the smaller of line 1 or line 4 here and include that amount

on Schedule C, line 30. If zero or less, enter -0-

5)

................ .... ..... ..... .... ..... .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. ..

6) Carryover of unallowed expenses from 2016 that are not allowed in 2017.

6a) Operating expenses. Enter the amount from your 2016 Form 8829, line 42

6a)

. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. ..

6b) Excess casualty losses and depreciation. Enter the amount from your 2016 Form 8829, line 43

6b)

.. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .

Instructions for the Simplified Method Worksheet

Use this worksheet to figure the amount of expenses you may deduct for a qualified business use of a home if you are electing to use the

simplified method for that home. If you are not electing to use the simplified method, use Form 8829.

Line 1. If all gross income from the trade or business is from this qualified business use of home, figure the gross income

limitation as follows.

A) Enter the amount from Schedule C, line 29

A)

......................... .... ..... ..... .... ..... .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .

B) Enter any gain derived from the business use of home and shown on Form 8949 (and included on Schedule D)

or Form 4797

B)

. .. . .. . .. .. . ........................................................... .... ..... ..... .... ..... ... . .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .

C) Add lines A and B

C)

. . ............................................................. ..... .... ..... .... ..... .. .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . .. .

D) Enter the loss (as a positive number) shown on Form 8949 (and included on Schedule D) or Form 4797 that are

allocable to the business, but not allocable to the use of the home

D)

.. ..... ... . .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .

E) Gross income limitation. Subtract line D from line C. Enter the result here and on line 1

E)

. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. .. . ..

If some of the income is from a place of business other than your home, you must first determine the part of your gross income (Schedule C,

line 7, and gains from Form 8949, Schedule D, and Form 4797) from the business use of your home. In making this determination, consider the

amount of time you spend at each location as well as other facts. After determining the part of your gross income from the business use of

your home, subtract from that amount the total expenses shown on Schedule C, line 28, plus any losses shown on Form 8949 (and included

on Schedule D) or Form 4797 that are allocable to the business in which you use your home but that are not allocable to the use of the home.

Enter the result on Line 1.

Note: If you had more than one home in which you conducted this business during the year, include only the income earned and the

deductions attributable to that income during the period you owned the home for which you elected to use the simplified method.

Line 2. If you used the same area for the entire year, enter the smaller of the square feet you actually used or 300. If you and your spouse

conducted the business as a qualified joint venture, split the square feet between you and your spouse in the same manner you split your

other tax attributes. If you shared space with someone else, or the area you used changed during the year, see the Instructions for Schedule

C to determine the amount to include on this line. Do not enter more than 300 square feet or, if applicable, the average monthly allowable

square footage on this line. See Part-year use or area changes, page 5-15, TheTaxBook, 1040 Edition/Deluxe Edition, for more information on

how to figure your average monthly allowable square footage.

Line 3b. If your qualified business use is providing daycare, you may need to account for the time that you used the same part of your home

for other purposes. If you used the part of your home exclusively and regularly for providing daycare, enter 1.0 on line 3b. If you did not use

the part of your home exclusively for providing daycare, complete the Schedule C—Daycare Facility Worksheet to figure what number to

enter on line 3b.

Line 6. Since you are using the simplified method this year, you cannot deduct the amounts you entered on lines 6a and 6b this year. If

you file Form 8829 next year for your qualified business use of this home, you will be able to include these expenses when you figure your

deduction.

Tools for Tax Pros

TheTaxBook™

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1