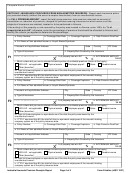

Complete Name of Insured

a. Policy Number

b. Coverage Start Date

c. Coverage Expiration

d. Date Premium Due/Paid

e. Full Name of Non-admitted Insurer or Lloyd's Broker/Syndicate

f. Insurer's or Lloyd's Broker Address

City

State

Country

ZIP Code

g. Type of Insurance

h. Property/Risk Covered by the Insurance

i.

j. % of property/risk w/in AZ

k. AZ PREMIUM AMOUNT

X

FULL PREMIUM AMOUNT

F4

=

%

$0.00

l. Which criteria did you use to allocate Arizona's portion of multistate premium (check all that apply):

100% AZ - not applicable

Physical assets

Employee payroll

Sales

Taxable income

Other (describe): __________________________________________________________________________

m. Total full-time employees or equivalents as of the date the policy was issued by the

unauthorized insurer:

n. If "F1k" was less than 80, the total full-time or equivalent employees of the insured's holding

company system as of the policy issuance date:

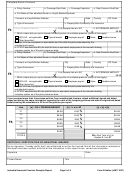

a. Policy Number

b. Coverage Start Date

c. Coverage Expiration

d. Date Premium Due/Paid

e. Full Name of Non-admitted Insurer or Lloyd's Broker/Syndicate

f. Insurer's or Lloyd's Broker Address

City

State

Country

ZIP Code

g. Type of Insurance

h. Property/Risk Covered by the Insurance

i.

j. % of property/risk w/in AZ

k. AZ PREMIUM AMOUNT

FULL PREMIUM AMOUNT

X

F5

=

%

$0.00

l. Which criteria did you use to allocate Arizona's portion of multistate premium (check all that apply):

100% AZ - not applicable

Physical assets

Employee payroll

Sales

Taxable income

Other (describe): __________________________________________________________________________

m. Total full-time employees or equivalents as of the date the policy was issued by the

unauthorized insurer:

n. If "F1k" was less than 80, the total full-time or equivalent employees of the insured's holding

company system as of the policy issuance date:

If you procured more than 5 insurance policies from unauthorized insurers, attach additional signed and dated

pages containing the same information requested for each of the foregoing policies and attach a signed and dated

sheet showing the calculation in F6 for all the policies you report.

Line

[a] - FULL PREMIUM AMOUNT

[b] - % w/in AZ

[c] = [a] x [b]

%

$0.00

0.00

$0.00

F1

%

$0.00

0.00

$0.00

F2

%

$0.00

0.00

$0.00

F3

%

$0.00

0.00

$0.00

F6

F4

%

$0.00

0.00

$0.00

F5

$0.00

$0.00

COLUMN

F6c: Post Total of [c] to

TOTALS

Section B, Line B1

SECTION G: CERTIFICATION OF INDUSTRIAL INSURED

By my signature, I hereby certify that I am authorized to act for the Insured, that all the information contained in

this report has been verified, and that all the information in this report is true, correct and complete.

Signature

Date

__________________________________________________________

Printed Name

Title

Industrial Insureds Premium Receipts Report

Page 5 of 5

Form E-IndIns (v20111027)

1

1 2

2 3

3 4

4 5

5