Form Gpcl1 - Government-Paid Childcare Leave (Gpcl) Scheme Declaration By Employee

ADVERTISEMENT

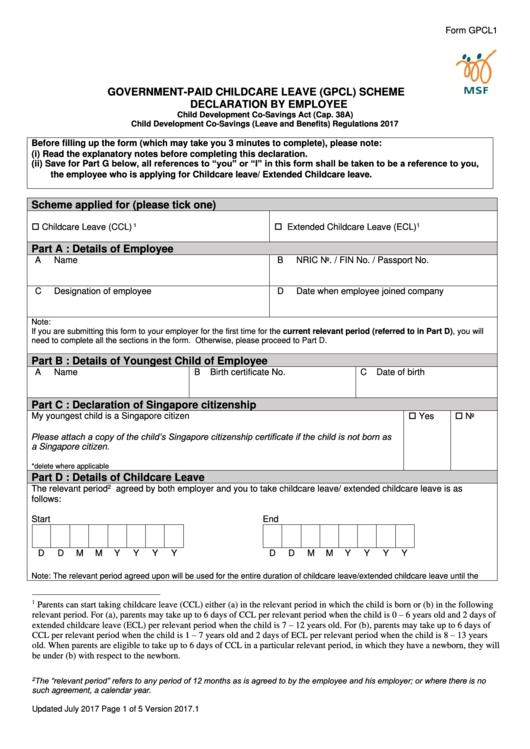

Form GPCL1

GOVERNMENT-PAID CHILDCARE LEAVE (GPCL) SCHEME

DECLARATION BY EMPLOYEE

Child Development Co-Savings Act (Cap. 38A)

Child Development Co-Savings (Leave and Benefits) Regulations 2017

Before filling up the form (which may take you 3 minutes to complete), please note:

(i)

Read the explanatory notes before completing this declaration.

(ii) Save for Part G below, all references to “you” or “I” in this form shall be taken to be a reference to you,

the employee who is applying for Childcare leave/ Extended Childcare leave.

Scheme applied for (please tick one)

Childcare Leave (CCL)

Extended Childcare Leave (ECL)

1

1

Part A : Details of Employee

A

Name

B

NRIC No. / FIN No. / Passport No.

C

Designation of employee

D

Date when employee joined company

Note:

If you are submitting this form to your employer for the first time for the current relevant period (referred to in Part D), you will

need to complete all the sections in the form. Otherwise, please proceed to Part D.

Part B : Details of Youngest Child of Employee

A

Name

B

Birth certificate No.

C

Date of birth

Part C : Declaration of Singapore citizenship

Yes

No

My youngest child is a Singapore citizen

Please attach a copy of the child’s Singapore citizenship certificate if the child is not born as

a Singapore citizen.

*delete where applicable

Part D : Details of Childcare Leave

2

The relevant period

agreed by both employer and you to take childcare leave/ extended childcare leave is as

follows:

Start

End

D

D

M

M

Y

Y

Y

Y

D

D

M

M

Y

Y

Y

Y

Note: The relevant period agreed upon will be used for the entire duration of childcare leave/extended childcare leave until the

1

Parents can start taking childcare leave (CCL) either (a) in the relevant period in which the child is born or (b) in the following

relevant period. For (a), parents may take up to 6 days of CCL per relevant period when the child is 0 – 6 years old and 2 days of

extended childcare leave (ECL) per relevant period when the child is 7 – 12 years old. For (b), parents may take up to 6 days of

CCL per relevant period when the child is 1 – 7 years old and 2 days of ECL per relevant period when the child is 8 – 13 years

old. When parents are eligible to take up to 6 days of CCL in a particular relevant period, in which they have a newborn, they will

be under (b) with respect to the newborn.

The “relevant period” refers to any period of 12 months as is agreed to by the employee and his employer; or where there is no

2

such agreement, a calendar year.

Updated July 2017

Page 1 of 5

Version 2017.1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5