Instructions For Production Tax Returns As 43.55 - Monthly Signature Page To Accompany Cd-R

ADVERTISEMENT

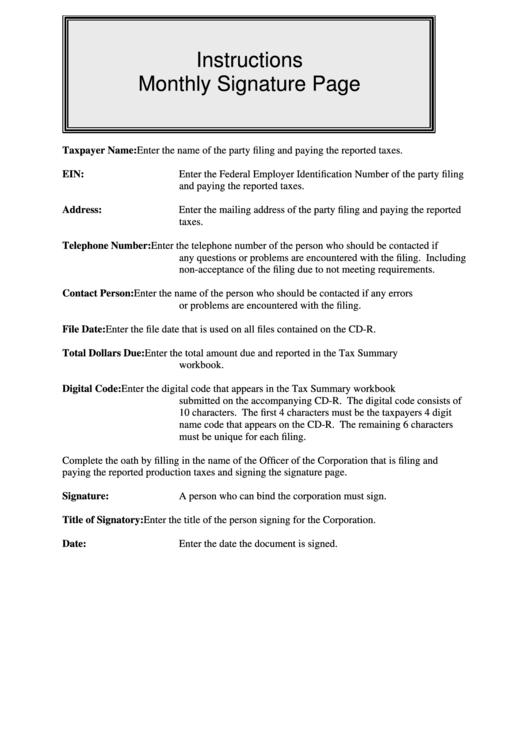

Instructions

Monthly Signature Page

Taxpayer Name:

Enter the name of the party filing and paying the reported taxes.

EIN:

Enter the Federal Employer Identification Number of the party filing

and paying the reported taxes.

Address:

Enter the mailing address of the party filing and paying the reported

taxes.

Telephone Number:

Enter the telephone number of the person who should be contacted if

any questions or problems are encountered with the filing. Including

non-acceptance of the filing due to not meeting requirements.

Contact Person:

Enter the name of the person who should be contacted if any errors

or problems are encountered with the filing.

File Date:

Enter the file date that is used on all files contained on the CD-R.

Total Dollars Due:

Enter the total amount due and reported in the Tax Summary

workbook.

Digital Code:

Enter the digital code that appears in the Tax Summary workbook

submitted on the accompanying CD-R. The digital code consists of

10 characters. The first 4 characters must be the taxpayers 4 digit

name code that appears on the CD-R. The remaining 6 characters

must be unique for each filing.

Complete the oath by filling in the name of the Officer of the Corporation that is filing and

paying the reported production taxes and signing the signature page.

Signature:

A person who can bind the corporation must sign.

Title of Signatory:

Enter the title of the person signing for the Corporation.

Date:

Enter the date the document is signed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1