Form 5300 - Call Report - National Credit Union Administration Page 17

ADVERTISEMENT

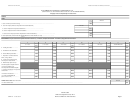

Credit Union Name:_________________________________________

Federal Charter/Certificate Number:________________

SCHEDULE A

SPECIALIZED LENDING AS OF: _______________

Section 1: If your credit union has indirect loans, complete this section.

Section 2: If your credit union has any real estate loans outstanding or has originated any real estate loans year-to-date, complete this section.

Section 3: If your credit union has any participation loans outstanding or purchased or sold loans or participations year-to-date, complete this section.

Section 4: If your credit union has any commercial loans outstanding or has originated/purchased any commercial loans year-to-date, complete this section. If these loans are secured by real estate, complete

section 2 also.

Section 5: If your credit union has any Troubled Debt Restructured loans outstanding or has modified any loans year-to-date, complete this section.

Section 6: If your credit union has purchased or obtained credit impaired loans in a merger, complete this section.

SECTION 1 - INDIRECT LOANS

Acct

Acct

1. INDIRECT LOANS

Number

Amount

Code

Code

617B

618B

a. Indirect Loans - Point of Sale Arrangement……………………………………

617C

618C

b. Indirect Loans - Outsourced Lending Relationship……………………………

617A

618A

c. TOTAL OUTSTANDING INDIRECT LOANS……………...……………………..

You may stop here if your credit union has no real estate loans or commercial loans outstanding and has not originated any real estate loans or commerical loans year-to-date or if your credit union has not

purchased or sold any loans or does not have any participation loans outstanding.

SECTION 2 - REAL ESTATE LOANS AND LINES OF CREDIT - INCLUDING COMMERCIAL LOANS SECURED BY REAL ESTATE

REAL ESTATE LOANS

FIRST MORTGAGE

Acct

Acct

No. of Loans Granted

Acct

Acct

Amt of Loans Outstanding

1.

Fixed Rate

No. of Loans Outstanding

Amount Granted Year-To-Date

Code

Code

Year- to-Date

Code

Code

a. > 15 Years…………….

972A

704A

982A

720A

972B

704B

982B

720B

b. 15 Years or less……...

2.

Balloon/Hybrid

a. > 5 Years………………

972C

704C

982C

720C

b. 5 Years or less……….

972D

704D

982D

720D

3.

Other Fixed Rate…………

972E

704E

982E

720E

4.

Adjustable Rate 1 yr or less

973A

705A

983A

721A

5.

Adjustable Rate > 1 yr……

973B

705B

983B

721B

Total 1st Mortgage Real Estate Loans/Lines of Credit (sum lines 1-5)………………………………..

6.

703

OTHER REAL ESTATE

7.

Closed-End Fixed Rate……

974

706

984

722

8.

Closed-End Adjustable Rate

975

707

985

723

9.

Open-End Adjustable Rate

976

708

986

724

10. Open-End Fixed Rate…….

976B

708B

986B

724B

Total Other Real Estate Loans/Lines of Credit (sum lines 7-10)..………………………………………

11.

386

12. TOTALS (all columns, lines 1 - 5 and 7 - 10)

978

710

988

726

MISCELLANEOUS REAL ESTATE LOANS/

Acct

Acct

LINES OF CREDIT INFORMATION

No. of Loans Outstanding

Acct Code

Amount Outstanding

Code

Amount Granted YTD

Code

13. Interest Only & Payment Option 1st Mortgage Loans

704C2

704C1

704C3

14. Interest Only & Payment Option Other RE/LOC Loans

704D1

704D2

704D3

Acct

Acct

No. of Loans Granted

Acct

Acct

Amt of Loans Outstanding

No. of Loans Outstanding

Amount Granted YTD

15.

REVERSE MORTGAGES

Code

Code

YTD

Code

Code

a. Federally Insured Home Equity Conversion Mortgage (HECM)

704F1

704F2

704F3

704F4

b. Proprietary Reverse Mortgage Products

704G1

704G2

704G3

704G4

NCUA 5300

Effective September 30, 2017

OMB No. 3133-0004

Page 14

Previous Editions Are Obsolete

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29