Hospitality Tax Return - City Of Lancaster

ADVERTISEMENT

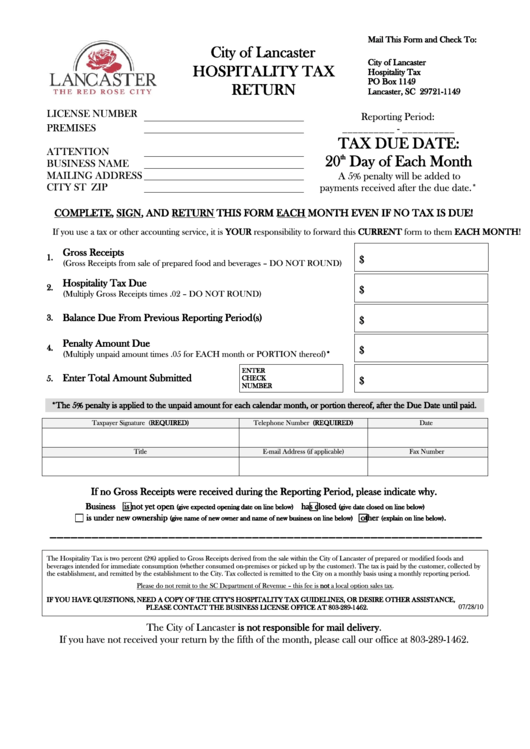

Mail This Form and Check To:

City of Lancaster

City of Lancaster

HOSPITALITY TAX

Hospitality Tax

PO Box 1149

RETURN

Lancaster, SC 29721-1149

LICENSE NUMBER

Reporting Period:

PREMISES

__________ - __________

TAX DUE DATE:

ATTENTION

th

20

Day of Each Month

BUSINESS NAME

MAILING ADDRESS

A 5% penalty will be added to

CITY ST ZIP

payments received after the due date.*

COMPLETE, SIGN, AND RETURN THIS FORM EACH MONTH EVEN IF NO TAX IS DUE!

If you use a tax or other accounting service, it is YOUR responsibility to forward this CURRENT form to them EACH MONTH!

Gross Receipts

1.

$

(Gross Receipts from sale of prepared food and beverages – DO NOT ROUND)

Hospitality Tax Due

2.

$

(Multiply Gross Receipts times .02 – DO NOT ROUND)

Balance Due From Previous Reporting Period(s)

3.

$

Penalty Amount Due

4.

$

(Multiply unpaid amount times .05 for EACH month or PORTION thereof)*

ENTER

Enter Total Amount Submitted

5.

CHECK

$

NUMBER

*The 5% penalty is applied to the unpaid amount for each calendar month, or portion thereof, after the Due Date until paid.

Taxpayer Signature (REQUIRED)

Telephone Number (REQUIRED)

Date

Title

E-mail Address (if applicable)

Fax Number

If no Gross Receipts were received during the Reporting Period, please indicate why.

Business

is not yet open

has closed

(give expected opening date on line below)

(give date closed on line below)

is under new ownership

other

.

(give name of new owner and name of new business on line below)

(explain on line below)

______________________________________________________________

The Hospitality Tax is two percent (2%) applied to Gross Receipts derived from the sale within the City of Lancaster of prepared or modified foods and

beverages intended for immediate consumption (whether consumed on-premises or picked up by the customer). The tax is paid by the customer, collected by

the establishment, and remitted by the establishment to the City. Tax collected is remitted to the City on a monthly basis using a monthly reporting period.

Please do not remit to the SC Department of Revenue – this fee is not a local option sales tax.

IF YOU HAVE QUESTIONS, NEED A COPY OF THE CITY’S HOSPITALITY TAX GUIDELINES, OR DESIRE OTHER ASSISTANCE,

PLEASE CONTACT THE BUSINESS LICENSE OFFICE AT 803-289-1462.

The City of Lancaster is not responsible for mail delivery.

If you have not received your return by the fifth of the month, please call our office at 803-289-1462.

07/28/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1