Tax Filing Instructions - City Tax Return - City Of Reading - 2006

ADVERTISEMENT

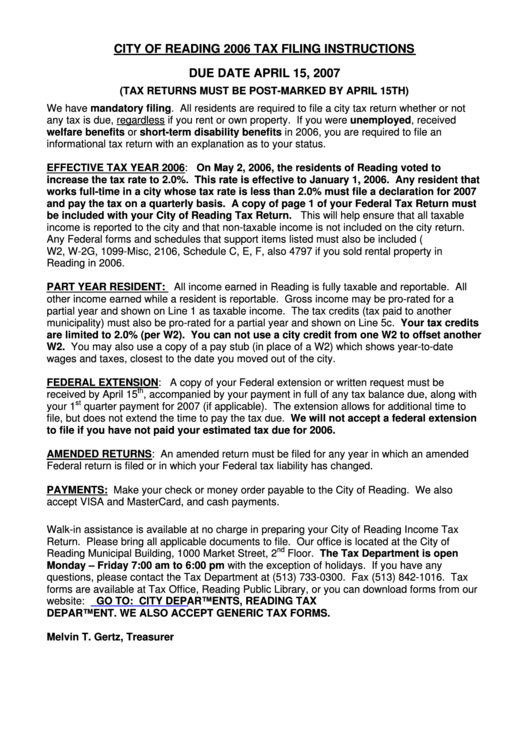

CITY OF READING 2006 TAX FILING INSTRUCTIONS

DUE DATE APRIL 15, 2007

(TAX RETURNS MUST BE POST-MARKED BY APRIL 15TH)

We have mandatory filing. All residents are required to file a city tax return whether or not

any tax is due, regardless if you rent or own property. If you were unemployed, received

welfare benefits or short-term disability benefits in 2006, you are required to file an

informational tax return with an explanation as to your status.

EFFECTIVE TAX YEAR 2006: On May 2, 2006, the residents of Reading voted to

increase the tax rate to 2.0%. This rate is effective to January 1, 2006. Any resident that

works full-time in a city whose tax rate is less than 2.0% must file a declaration for 2007

and pay the tax on a quarterly basis. A copy of page 1 of your Federal Tax Return must

be included with your City of Reading Tax Return. This will help ensure that all taxable

income is reported to the city and that non-taxable income is not included on the city return.

Any Federal forms and schedules that support items listed must also be included (e.g. Forms

W2, W-2G, 1099-Misc, 2106, Schedule C, E, F, also 4797 if you sold rental property in

Reading in 2006.

PART YEAR RESIDENT: All income earned in Reading is fully taxable and reportable. All

other income earned while a resident is reportable. Gross income may be pro-rated for a

partial year and shown on Line 1 as taxable income. The tax credits (tax paid to another

municipality) must also be pro-rated for a partial year and shown on Line 5c. Your tax credits

are limited to 2.0% (per W2). You can not use a city credit from one W2 to offset another

W2. You may also use a copy of a pay stub (in place of a W2) which shows year-to-date

wages and taxes, closest to the date you moved out of the city.

FEDERAL EXTENSION: A copy of your Federal extension or written request must be

th

received by April 15

, accompanied by your payment in full of any tax balance due, along with

st

your 1

quarter payment for 2007 (if applicable). The extension allows for additional time to

file, but does not extend the time to pay the tax due. We will not accept a federal extension

to file if you have not paid your estimated tax due for 2006.

AMENDED RETURNS: An amended return must be filed for any year in which an amended

Federal return is filed or in which your Federal tax liability has changed.

PAYMENTS: Make your check or money order payable to the City of Reading. We also

accept VISA and MasterCard, and cash payments.

Walk-in assistance is available at no charge in preparing your City of Reading Income Tax

Return. Please bring all applicable documents to file. Our office is located at the City of

nd

Reading Municipal Building, 1000 Market Street, 2

Floor. The Tax Department is open

Monday – Friday 7:00 am to 6:00 pm with the exception of holidays. If you have any

questions, please contact the Tax Department at (513) 733-0300. Fax (513) 842-1016. Tax

forms are available at Tax Office, Reading Public Library, or you can download forms from our

website:

GO TO: CITY DEPARTMENTS, READING TAX

DEPARTMENT. WE ALSO ACCEPT GENERIC TAX FORMS.

Melvin T. Gertz, Treasurer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1