Form P45 Draft - Details Of Employee Leaving Work

ADVERTISEMENT

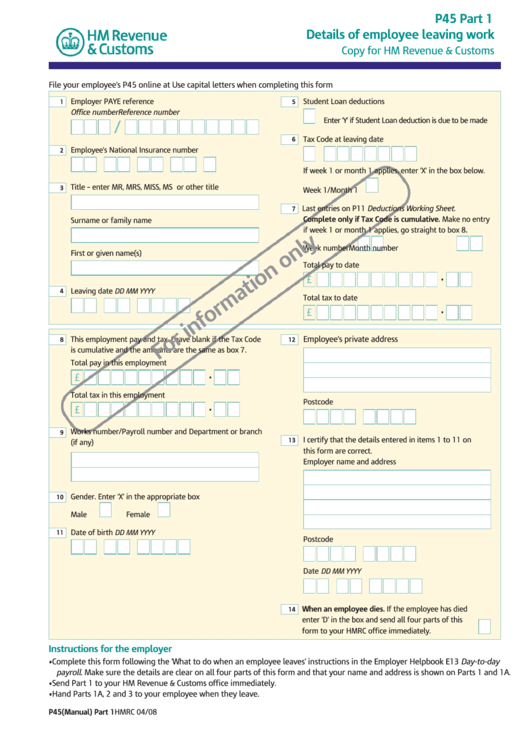

P45 Part 1

Details of employee leaving work

Copy for HM Revenue & Customs

File your employee's P45 online at

Use capital letters when completing this form

Employer PAYE reference

Student Loan deductions

1

5

Office number Reference number

Enter 'Y' if Student Loan deduction is due to be made

/

Tax Code at leaving date

6

Employee's National Insurance number

2

If week 1 or month 1 applies, enter 'X' in the box below.

Title – enter MR, MRS, MISS, MS or other title

3

Week 1/Month 1

Last entries on P11 Deductions Working Sheet.

7

Complete only if Tax Code is cumulative. Make no entry

Surname or family name

if week 1 or month 1 applies, go straight to box 8.

Week number

Month number

First or given name(s)

Total pay to date

£

•

Leaving date

DD MM YYYY

4

Total tax to date

£

•

Employee’s private address

This employment pay and tax. Leave blank if the Tax Code

8

12

is cumulative and the amounts are the same as box 7.

Total pay in this employment

£

•

Total tax in this employment

Postcode

£

•

Works number/Payroll number and Department or branch

9

I certify that the details entered in items 1 to 11 on

13

(if any)

this form are correct.

Employer name and address

Gender. Enter ‘X’ in the appropriate box

10

Male

Female

Date of birth

DD MM YYYY

11

Postcode

Date

DD MM YYYY

When an employee dies. If the employee has died

14

enter 'D' in the box and send all four parts of this

form to your HMRC office immediately.

Instructions for the employer

• Complete this form following the 'What to do when an employee leaves' instructions in the Employer Helpbook E13 Day-to-day

payroll. Make sure the details are clear on all four parts of this form and that your name and address is shown on Parts 1 and 1A.

• Send Part 1 to your HM Revenue & Customs office immediately.

• Hand Parts 1A, 2 and 3 to your employee when they leave.

P45(Manual) Part 1

HMRC 04/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4