RESET FORM

PRINT FORM

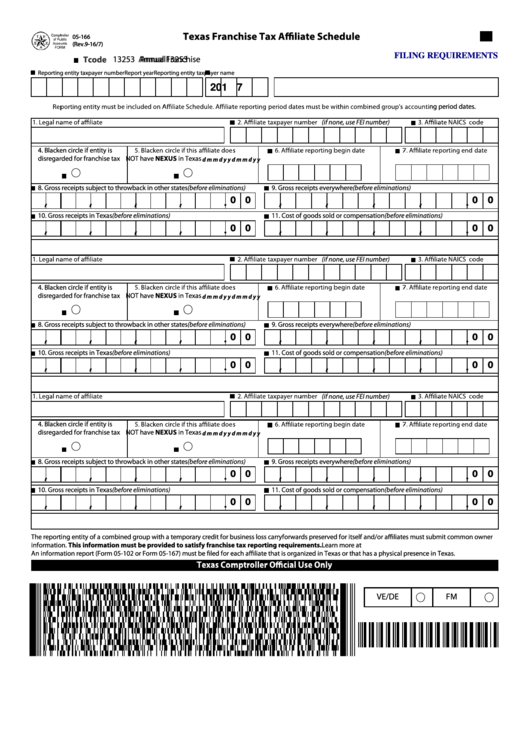

Texas Franchise Tax A liate Schedule

05-166

05-166

(Rev.9-16/7)

(Rev.9-16/7)

FILING REQUIREMENTS

Tcode

13253

13253 Annual Franchise

Annual

Reporting entity taxpayer number

Report year

Reporting entity taxpayer name

2 0 1 7

ng period dates.

(if none, use FEI number)

4. Blacken circle if entity is

disregarded for franchise tax

NOT have NEXUS in Texas

m

m

d

d

y

y

m

m

d

d

y

y

8. Gross receipts subject to throwback in other states (before eliminations)

9. Gross receipts everywhere (before eliminations)

0 0

0 0

10. Gross receipts in Texas (before eliminations)

11. Cost of goods sold or compensation (before eliminations)

0 0

0 0

(if none, use FEI number)

4. Blacken circle if entity is

disregarded for franchise tax

NOT have NEXUS in Texas

m

m

d

d

y

y

m

m

d

d

y

y

8. Gross receipts subject to throwback in other states (before eliminations)

9. Gross receipts everywhere (before eliminations)

0 0

0 0

10. Gross receipts in Texas (before eliminations)

11. Cost of goods sold or compensation (before eliminations)

0 0

0 0

(if none, use FEI number)

4. Blacken circle if entity is

NOT have NEXUS in Texas

disregarded for franchise tax

m

m

d

d

y

y

m

m

d

d

y

y

8. Gross receipts subject to throwback in other states (before eliminations)

9. Gross receipts everywhere (before eliminations)

0 0

0 0

10. Gross receipts in Texas (before eliminations)

11. Cost of goods sold or compensation (before eliminations)

0 0

0 0

The reporting entity of a combined group with a temporary credit for business loss carryforwards preserved for itself and/or a liates must submit common owner

information. This information must be provided to satisfy franchise tax reporting requirements. Learn more at

An information report (Form 05-102 or Form 05-167) must be led for each a liate that is organized in Texas or that has a physical presence in Texas.

VE/DE

FM

1

1