RESET FORM

PRINT FORM

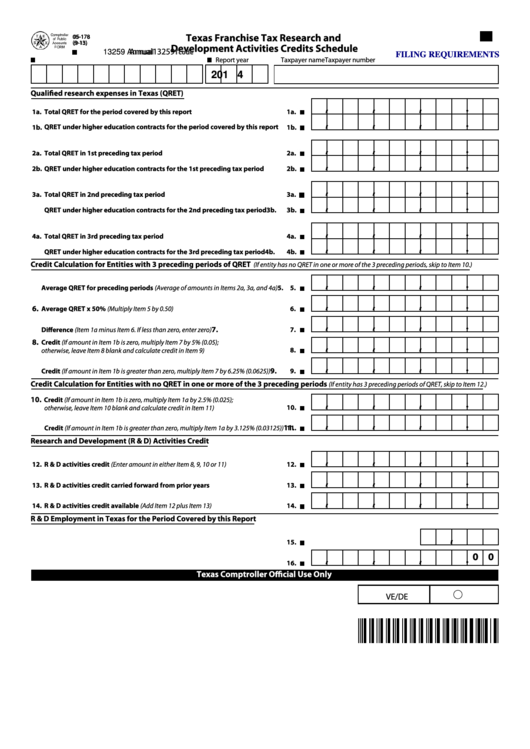

Texas Franchise Tax Research and

05-178

05-178

(9-13)

(9-13)

Development Activities Credits Schedule

13259

Annual

Tcode

13259 Annual

FILING REQUIREMENTS

Taxpayer number

Report year

Taxpayer name

2 0 1 4

Quali ed research expenses in Texas (QRET)

1a.

Total QRET for the period covered by this report

1a.

QRET under higher education contracts for the period covered by this report

1b.

1b.

2a.

Total QRET in 1st preceding tax period

2a.

2b.

QRET under higher education contracts for the 1st preceding tax period

2b.

3a.

Total QRET in 2nd preceding tax period

3a.

3b.

QRET under higher education contracts for the 2nd preceding tax period

3b.

4a.

Total QRET in 3rd preceding tax period

4a.

4b.

QRET under higher education contracts for the 3rd preceding tax period

4b.

Credit Calculation for Entities with 3 preceding periods of QRET

(If entity has no QRET in one or more of the 3 preceding periods, skip to Item 10.)

5.

Average QRET for preceding periods (Average of amounts in Items 2a, 3a, and 4a)

5.

6.

Average QRET x 50% (Multiply Item 5 by 0.50)

6.

7.

Di erence (Item 1a minus Item 6. If less than zero, enter zero)

7.

8.

Credit (If amount in Item 1b is zero, multiply Item 7 by 5% (0.05);

8.

otherwise, leave Item 8 blank and calculate credit in Item 9)

9.

Credit (If amount in Item 1b is greater than zero, multiply Item 7 by 6.25% (0.0625))

9.

Credit Calculation for Entities with no QRET in one or more of the 3 preceding periods

(If entity has 3 preceding periods of QRET, skip to Item 12.)

10.

Credit (If amount in Item 1b is zero, multiply Item 1a by 2.5% (0.025);

10.

otherwise, leave Item 10 blank and calculate credit in Item 11)

11.

Credit (If amount in Item 1b is greater than zero, multiply Item 1a by 3.125% (0.03125))

11.

Research and Development (R & D) Activities Credit

12.

R & D activities credit (Enter amount in either Item 8, 9, 10 or 11)

12.

13.

R & D activities credit carried forward from prior years

13.

14.

R & D activities credit available (Add Item 12 plus Item 13)

14.

R & D Employment in Texas for the Period Covered by this Report

15. Average number of research and development positions

15.

0 0

16. Average salary of research and development positions

16.

Texas Comptroller O cial Use Only

VE/DE

1

1