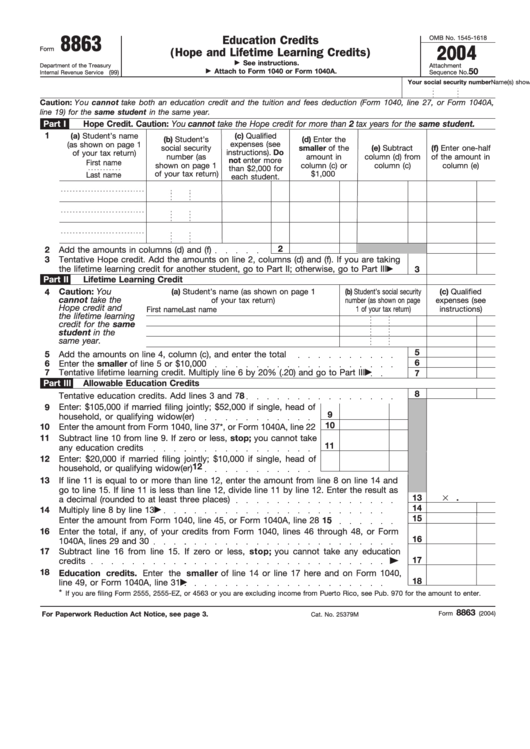

8863

OMB No. 1545-1618

Education Credits

2004

Form

(Hope and Lifetime Learning Credits)

See instructions.

Department of the Treasury

Attachment

50

Attach to Form 1040 or Form 1040A.

Internal Revenue Service

(99)

Sequence No.

Name(s) shown on return

Your social security number

Caution: You cannot take both an education credit and the tuition and fees deduction (Form 1040, line 27, or Form 1040A,

line 19) for the same student in the same year.

Part I

Hope Credit. Caution: You cannot take the Hope credit for more than 2 tax years for the same student.

1

(a) Student’s name

(c) Qualified

(b) Student’s

(d) Enter the

(as shown on page 1

expenses (see

social security

smaller of the

(e) Subtract

(f) Enter one-half

instructions). Do

of your tax return)

number (as

amount in

column (d) from

of the amount in

not enter more

First name

shown on page 1

column (c) or

column (c)

column (e)

than $2,000 for

of your tax return)

$1,000

Last name

each student.

2

2

Add the amounts in columns (d) and (f)

3

Tentative Hope credit. Add the amounts on line 2, columns (d) and (f). If you are taking

the lifetime learning credit for another student, go to Part II; otherwise, go to Part III

3

Part II

Lifetime Learning Credit

Caution: You

4

(a) Student’s name (as shown on page 1

(b) Student’s social security

(c) Qualified

cannot take the

of your tax return)

number (as shown on page

expenses (see

Hope credit and

1 of your tax return)

instructions)

First name

Last name

the lifetime learning

credit for the same

student in the

same year.

5

5

Add the amounts on line 4, column (c), and enter the total

6

6

Enter the smaller of line 5 or $10,000

7

Tentative lifetime learning credit. Multiply line 6 by 20% (.20) and go to Part III

7

Part III

Allowable Education Credits

8

8

Tentative education credits. Add lines 3 and 7

9

Enter: $105,000 if married filing jointly; $52,000 if single, head of

9

household, or qualifying widow(er)

10

10

Enter the amount from Form 1040, line 37*, or Form 1040A, line 22

11

Subtract line 10 from line 9. If zero or less, stop; you cannot take

11

any education credits

12

Enter: $20,000 if married filing jointly; $10,000 if single, head of

12

household, or qualifying widow(er)

13

If line 11 is equal to or more than line 12, enter the amount from line 8 on line 14 and

go to line 15. If line 11 is less than line 12, divide line 11 by line 12. Enter the result as

13

.

a decimal (rounded to at least three places)

14

14

Multiply line 8 by line 13

15

15

Enter the amount from Form 1040, line 45, or Form 1040A, line 28

16

Enter the total, if any, of your credits from Form 1040, lines 46 through 48, or Form

16

1040A, lines 29 and 30

17

Subtract line 16 from line 15. If zero or less, stop; you cannot take any education

17

credits

18

Education credits. Enter the smaller of line 14 or line 17 here and on Form 1040,

18

line 49, or Form 1040A, line 31

*

If you are filing Form 2555, 2555-EZ, or 4563 or you are excluding income from Puerto Rico, see Pub. 970 for the amount to enter.

8863

For Paperwork Reduction Act Notice, see page 3.

Form

(2004)

Cat. No. 25379M

1

1 2

2 3

3