Commercial Rent Tax Return - 1999/2000

ADVERTISEMENT

-

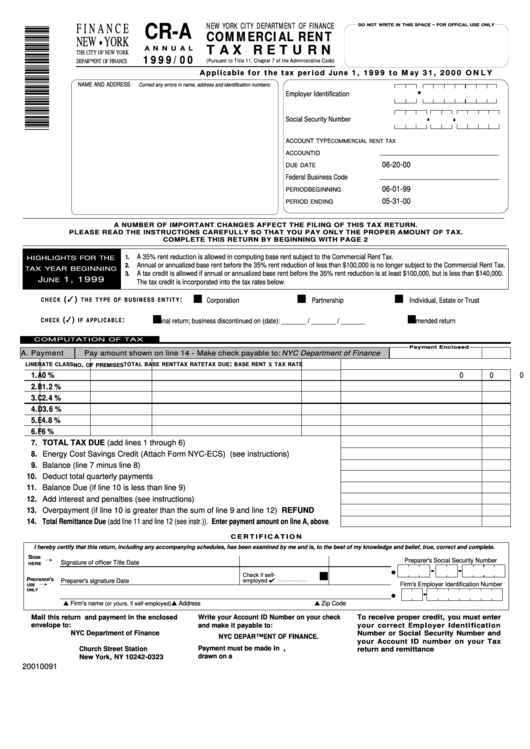

CR-A

NEW YORK CITY DEPARTMENT OF FINANCE

DO NOT WRITE IN THIS SPACE

FOR OFFICAL USE ONLY

F I N A N C E

COMMERCIAL RENT

NEW YORK

T A X R E T U R N

A N N U A L

THE CITY OF NEW YORK

1 9 9 9 / 0 0

(Pursuant to Title 11, Chapter 7 of the Administrative Code)

DEPARTMENT OF FINANCE

A p p l i c a b l e f o r t h e t a x p e r i o d J u n e 1 , 1 9 9 9 t o M a y 3 1 , 2 0 0 0 O N L Y

NAME AND ADDRESS

Correct any errors in name, address and identification numbers:

Employer Identification Number...

Social Security Number............

....................

ACCOUNT TYPE

COMMERCIAL RENT TAX

.......................

ACCOUNT ID

06-20-00

..............................

DUE DATE

.............

Federal Business Code

06-01-99

................

PERIOD BEGINNING

................... 05-31-00

PERIOD ENDING

A NUMBER OF IMPORTANT CHANGES AFFECT THE FILING OF THIS TAX RETURN.

PLEASE READ THE INSTRUCTIONS CAREFULLY SO THAT YOU PAY ONLY THE PROPER AMOUNT OF TAX.

COMPLETE THIS RETURN BY BEGINNING WITH PAGE 2

A 35% rent reduction is allowed in computing base rent subject to the Commercial Rent Tax.

1.

HIGHLIGHTS FOR THE

Annual or annualized base rent before the 35% rent reduction of less than $100,000 is no longer subject to the Commercial Rent Tax.

2.

TAX YEAR BEGINNING

A tax credit is allowed if annual or annualized base rent before the 35% rent reduction is at least $100,000, but is less than $140,000.

3.

J

1, 1999

UNE

The tax credit is incorporated into the tax rates below.

( )

:

C H E C K

T H E T Y P E O F B U S I N E S S E N T I T Y

Corporation

Partnership

Individual, Estate or Trust

:

( )

C H E C K

I F A P P L I C A B L E

Final return; business discontinued on (date): _______ / _______ / _______

Amended return

COMPUTATION OF TAX

Payment Enclosed

Pay amount shown on line 14 - Make check payable to: NYC Department of Finance

A. Payment

:

LINE

RATE CLASS

.

TOTAL BASE RENT

TAX RATE

TAX DUE

BASE RENT X TAX RATE

NO

OF PREMISES

1.

A

0 %

0

00

2.

B

1.2 %

3.

C

2.4 %

4.

D

3.6 %

5.

E

4.8 %

6.

F

6 %

7. TOTAL TAX DUE (add lines 1 through 6) .................................................................

8. Energy Cost Savings Credit (Attach Form NYC-ECS) (see instructions) ..................

9. Balance (line 7 minus line 8) ......................................................................................

10. Deduct total quarterly payments ................................................................................

11. Balance Due (if line 10 is less than line 9) .................................................................

12. Add interest and penalties (see instructions) .............................................................

13. Overpayment (if line 10 is greater than the sum of line 9 and line 12) ........REFUND

14. Total Remittance Due (add line 11 and line 12 (see instr.)). Enter payment amount on line A, above.

C E R T I F I C A T I O N

I hereby certify that this return, including any accompanying schedules, has been examined by me and is, to the best of my knowledge and belief, true, correct and complete.

S

IGN

Preparer's Social Security Number

Signature of officer

Title

Date

HERE

Check if self-

P

'

REPARER

S

Preparer's signature

Date

employed

Firm's Employer Identification Number

USE

ONLY

Firm's name

(or yours, if self-employed)

Address

Zip Code

Mail this return and payment in the enclosed

Write your Account ID Number on your check

To receive proper credit, you must enter

envelope to:

and make it payable to:

your correct Employer Identification

NYC Department of Finance

Number or Social Security Number and

NYC DEPARTMENT OF FINANCE.

P.O. Box 3213

your Account ID number on your Tax

Payment must be made in U.S. dollars,

Church Street Station

return and remittance

drawn on a U.S. bank.

New York, NY 10242-0323

20010091

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1