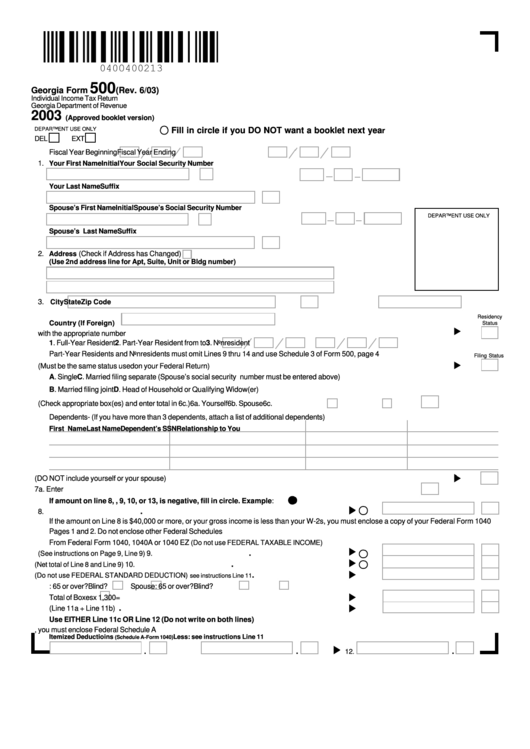

Georgia Form 500 - Individual Income Tax Return - 2003

ADVERTISEMENT

500

Georgia Form

(Rev. 6/03)

Individual Income Tax Return

Georgia Department of Revenue

2003

(Approved booklet version)

DEPARTMENT USE ONLY

Fill in circle if you DO NOT want a booklet next yea

r

DEL

EXT

Fiscal Year Beginning

Fiscal Year Ending

1.

Your First Name

Initial

Your Social Security Number

Your Last Name

Suffix

Spouse’s First Name

Initial

Spouse’s Social Security Number

DEPARTMENT USE ONLY

Spouse’s Last Name

Suffix

2.

(Check if Address has Changed)

Address

(Use 2nd address line for Apt, Suite, Unit or Bldg number)

3.

City

State

Zip Code

Residency

Country (If Foreign)

Status

4. Enter your Residency Status with the appropriate number ..........................................................................................................

4.

1. Full-Year Resident

2. Part-Year Resident from

to

3. Nonresident

Part-Year Residents and Nonresidents must omit Lines 9 thru 14 and use Schedule 3 of Form 500, page 4

Filing Status

5. Enter Filing Status with appropriate letter (Must be the same status used on your Federal Return) ............................................

5.

A. Single

C. Married filing separate (Spouse’s social security number must be entered above)

B. Married filing joint

D. Head of Household or Qualifying Widow(er)

6. Number of exemptions (Check appropriate box(es) and enter total in 6c.)

6a. Yourself

6b. Spouse

6c.

Dependents- (If you have more than 3 dependents, attach a list of additional dependents)

First Name

Last Name

Dependent’s SSN

Relationship to You

7a. Number of Dependents (DO NOT include yourself or your spouse) .........................................................................................

7a.

7b. Add Lines 6c and 7a. Enter total .........................................................................................................................

7b.

If amount on line 8, , 9, 10, or 13, is negative, fill in circle. Example:

.

8. Federal adjusted gross income ................................................................................................

8.

If the amount on Line 8 is $40,000 or more, or your gross income is less than your W-2s, you must enclose a copy of your Federal Form 1040

Pages 1 and 2. Do not enclose other Federal Schedules

From Federal Form 1040, 1040A or 1040 EZ

(Do not use FEDERAL TAXABLE INCOME)

.

9. Adjustments from Schedule 1

9.

(See instructions on Page 9, Line 9) ................................................

.

10. Georgia adjusted gross income

10.

(Net total of Line 8 and Line 9) .......................................................

.

11. Standard Deduction

(Do not use FEDERAL STANDARD DEDUCTION)

.....

11a.

see instructions Line 11

b.Self: 65 or over?

Blind?

Spouse: 65 or over?

Blind?

Total of Boxes

x 1,300= .................................................................................................

11b.

.

c.Total Standard Deduction (Line 11a + Line 11b) .....................................................................

11c.

Use EITHER Line 11c OR Line 12 (Do not write on both lines)

12. Total Itemized Deductions used in computing Federal Taxable Income. If you use itemized deductions, you must enclose Federal Schedule A

Itemized Deductioins

Less: see instructions Line 11

(Schedule A-Form 1040)

.

.

.

12.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4