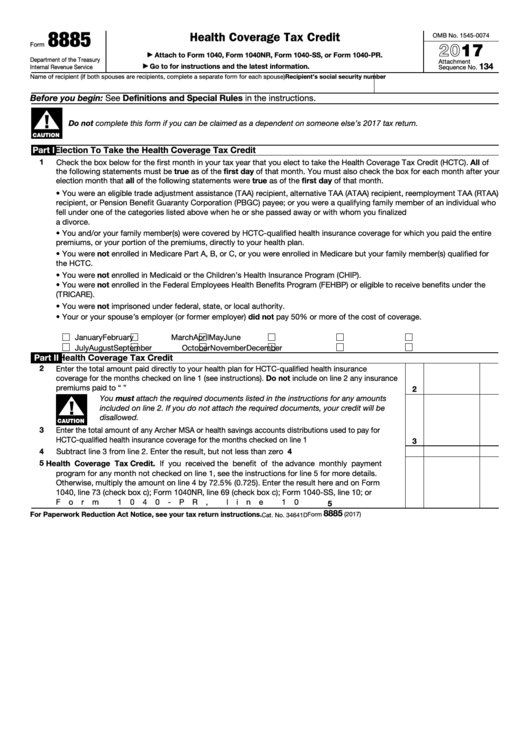

8885

Health Coverage Tax Credit

OMB No. 1545-0074

2017

Form

Attach to Form 1040, Form 1040NR, Form 1040-SS, or Form 1040-PR.

▶

Department of the Treasury

Attachment

134

Go to for instructions and the latest information.

Internal Revenue Service

▶

Sequence No.

Name of recipient (if both spouses are recipients, complete a separate form for each spouse)

Recipient’s social security number

Before you begin: See Definitions and Special Rules in the instructions.

▲

!

Do not complete this form if you can be claimed as a dependent on someone else’s 2017 tax return.

CAUTION

Part I

Election To Take the Health Coverage Tax Credit

1

Check the box below for the first month in your tax year that you elect to take the Health Coverage Tax Credit (HCTC). All of

the following statements must be true as of the first day of that month. You must also check the box for each month after your

election month that all of the following statements were true as of the first day of that month.

• You were an eligible trade adjustment assistance (TAA) recipient, alternative TAA (ATAA) recipient, reemployment TAA (RTAA)

recipient, or Pension Benefit Guaranty Corporation (PBGC) payee; or you were a qualifying family member of an individual who

fell under one of the categories listed above when he or she passed away or with whom you finalized

a divorce.

• You and/or your family member(s) were covered by HCTC-qualified health insurance coverage for which you paid the entire

premiums, or your portion of the premiums, directly to your health plan.

• You were not enrolled in Medicare Part A, B, or C, or you were enrolled in Medicare but your family member(s) qualified for

the HCTC.

• You were not enrolled in Medicaid or the Children’s Health Insurance Program (CHIP).

• You were not enrolled in the Federal Employees Health Benefits Program (FEHBP) or eligible to receive benefits under the

U.S. military health system (TRICARE).

• You were not imprisoned under federal, state, or local authority.

• Your or your spouse’s employer (or former employer) did not pay 50% or more of the cost of coverage.

January

February

March

April

May

June

July

August

September

October

November

December

Part II

Health Coverage Tax Credit

2

Enter the total amount paid directly to your health plan for HCTC-qualified health insurance

coverage for the months checked on line 1 (see instructions). Do not include on line 2 any insurance

premiums paid to “U.S. Treasury-HCTC” .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

▲

You must attach the required documents listed in the instructions for any amounts

!

included on line 2. If you do not attach the required documents, your credit will be

disallowed.

CAUTION

3

Enter the total amount of any Archer MSA or health savings accounts distributions used to pay for

HCTC-qualified health insurance coverage for the months checked on line 1 .

.

.

.

.

.

.

.

.

3

4

Subtract line 3 from line 2. Enter the result, but not less than zero

.

.

.

.

.

.

.

.

.

.

.

4

5

Health Coverage Tax Credit. If you received the benefit of the advance monthly payment

program for any month not checked on line 1, see the instructions for line 5 for more details.

Otherwise, multiply the amount on line 4 by 72.5% (0.725). Enter the result here and on Form

1040, line 73 (check box c); Form 1040NR, line 69 (check box c); Form 1040-SS, line 10; or

Form 1040-PR, line 10

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

8885

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2017)

Cat. No. 34641D

1

1