8

Form 1118 (Rev. 12-2015)

Page

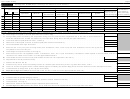

Schedule E

Tax Deemed Paid by Certain Third-, Fourth-, and Fifth-Tier Foreign Corporations Under Section 902(b) (Continued)

Part II—Tax Deemed Paid by Fourth-Tier Foreign Corporations (In general, include the column 10 results in column 6(b) of Part I. However, see instructions

for Schedule C, Part I, column 6(b) for an exception.)

3. Country of

4. Post-1986 Undistributed

5. Opening Balance in

1a. Name of Fifth-Tier Foreign Corporation and Its

1b. EIN (if any) of the

1c. Reference ID number

2. Tax Year End (Yr-Mo) (see

Incorporation (enter

Earnings (in functional

Post-1986 Foreign Income

Related Fourth-Tier Foreign Corporation

fifth-tier foreign corporation

(see instructions)

instructions)

country code - see

currency—attach schedule)

Taxes

instructions)

6. Foreign Taxes Paid and Deemed Paid for Tax Year Indicated

8. Dividends Paid (in functional currency)

7. Post-1986 Foreign Income

10. Tax Deemed Paid

9. Divide column 8(a) by

Taxes (add columns 5,

(multiply column 7 by

column 4

(b) Taxes Deemed Paid (from

6(a), and 6(b))

column 9)

(a) Taxes Paid

Part III, column 10)

(a) of Fifth-tier CFC

(b) of Fourth-tier CFC

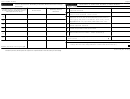

Part III—Tax Deemed Paid by Fifth-Tier Foreign Corporations (In general, include the column 10 results in column 6(b) of Part II above. However, see

instructions for Schedule C, Part I, column 6(b) for an exception.)

3. Country of

4. Post-1986 Undistributed

5. Opening Balance in

1a. Name of Sixth-Tier Foreign Corporation and

1b. EIN (if any) of the

1c. Reference ID number

2. Tax Year End (Yr-Mo) (see

Incorporation (enter

Earnings (in functional

Post-1986 Foreign Income

Its Related Fifth-Tier Foreign Corporation

sixth-tier foreign corporation

(see instructions)

instructions)

country code - see

currency—attach schedule)

Taxes

instructions)

8. Dividends Paid (in functional currency)

7. Post-1986 Foreign

10. Tax Deemed Paid

9. Divide column 8(a) by

6. Foreign Taxes Paid for Tax Year Indicated

Income Taxes

(multiply column 7 by

column 4

(add columns 5 and 6)

column 9)

(a) of Sixth-tier CFC

(b) of Fifth-tier CFC

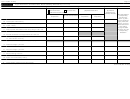

1118

Form

(Rev. 12-2015)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11