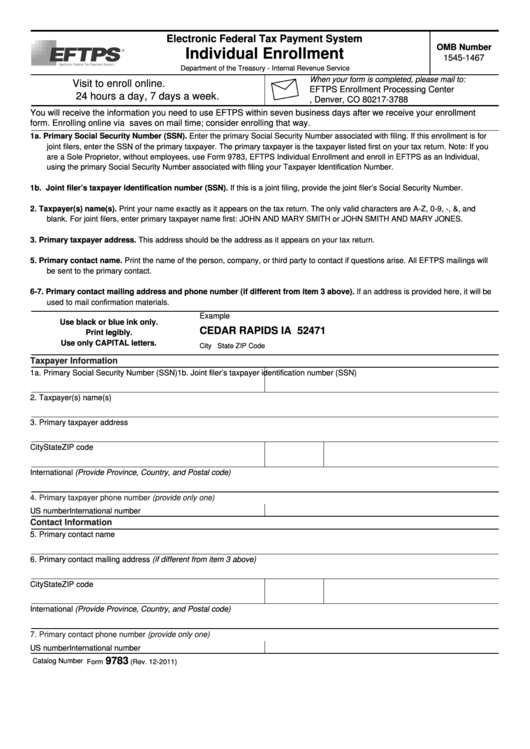

Electronic Federal Tax Payment System

OMB Number

Individual Enrollment

1545-1467

Department of the Treasury - Internal Revenue Service

When your form is completed, please mail to:

Visit EFTPS.gov to enroll online.

EFTPS Enrollment Processing Center

24 hours a day, 7 days a week.

P.O. Box 173788, Denver, CO 80217-3788

You will receive the information you need to use EFTPS within seven business days after we receive your enrollment

form. Enrolling online via EFTPS.gov saves on mail time; consider enrolling that way.

1a. Primary Social Security Number (SSN). Enter the primary Social Security Number associated with filing. If this enrollment is for

joint filers, enter the SSN of the primary taxpayer. The primary taxpayer is the taxpayer listed first on your tax return. Note: If you

are a Sole Proprietor, without employees, use Form 9783, EFTPS Individual Enrollment and enroll in EFTPS as an Individual,

using the primary Social Security Number associated with filing your Taxpayer Identification Number.

1b. Joint filer’s taxpayer identification number (SSN). If this is a joint filing, provide the joint filer’s Social Security Number.

2.

Taxpayer(s) name(s). Print your name exactly as it appears on the tax return. The only valid characters are A-Z, 0-9, -, &, and

blank. For joint filers, enter primary taxpayer name first: JOHN AND MARY SMITH or JOHN SMITH AND MARY JONES.

3.

Primary taxpayer address. This address should be the address as it appears on your tax return.

5.

Primary contact name. Print the name of the person, company, or third party to contact if questions arise. All EFTPS mailings will

be sent to the primary contact.

6-7. Primary contact mailing address and phone number (if different from item 3 above). If an address is provided here, it will be

used to mail confirmation materials.

Example

Use black or blue ink only.

CEDAR RAPIDS

IA

52471

Print legibly.

Use only CAPITAL letters.

City

State

ZIP Code

Taxpayer Information

1a. Primary Social Security Number (SSN)

1b. Joint filer’s taxpayer identification number (SSN)

2. Taxpayer(s) name(s)

3. Primary taxpayer address

City

State

ZIP code

International (Provide Province, Country, and Postal code)

4. Primary taxpayer phone number (provide only one)

US number

International number

Contact Information

5. Primary contact name

6. Primary contact mailing address (if different from item 3 above)

City

State

ZIP code

International (Provide Province, Country, and Postal code)

7. Primary contact phone number (provide only one)

US number

International number

9783

Catalog Number 21820C

Form

(Rev. 12-2011)

1

1 2

2