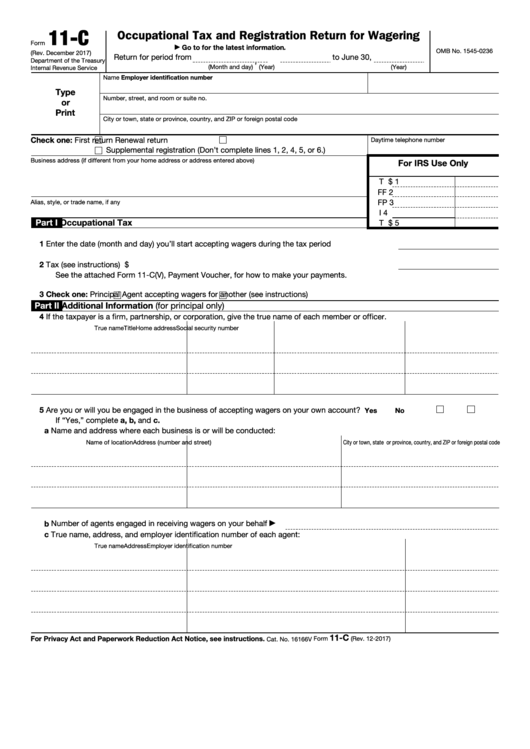

11-C

Occupational Tax and Registration Return for Wagering

Form

Go to for the latest information.

▶

OMB No. 1545-0236

(Rev. December 2017)

Return for period from

to June 30,

,

Department of the Treasury

(Month and day)

(Year)

(Year)

Internal Revenue Service

Employer identification number

Name

Type

Number, street, and room or suite no.

or

Print

City or town, state or province, country, and ZIP or foreign postal code

Check one:

First return

Renewal return

Daytime telephone number

Supplemental registration (Don’t complete lines 1, 2, 4, 5, or 6.)

Business address (if different from your home address or address entered above)

For IRS Use Only

T $

1

FF

2

FP

3

Alias, style, or trade name, if any

I

4

Part I

Occupational Tax

T $

5

1

Enter the date (month and day) you’ll start accepting wagers during the tax period .

.

.

.

2

Tax (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$

See the attached Form 11-C(V), Payment Voucher, for how to make your payments.

3

Check one:

Principal

Agent accepting wagers for another (see instructions)

Part II

Additional Information (for principal only)

4

If the taxpayer is a firm, partnership, or corporation, give the true name of each member or officer.

True name

Title

Home address

Social security number

5

Are you or will you be engaged in the business of accepting wagers on your own account? .

.

.

.

.

Yes

No

If “Yes,” complete a, b, and c.

a Name and address where each business is or will be conducted:

Name of location

Address (number and street)

City or town, state or province, country, and ZIP or foreign postal code

b Number of agents engaged in receiving wagers on your behalf

▶

c True name, address, and employer identification number of each agent:

True name

Address

Employer identification number

11-C

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2017)

Cat. No. 16166V

1

1 2

2 3

3 4

4 5

5 6

6