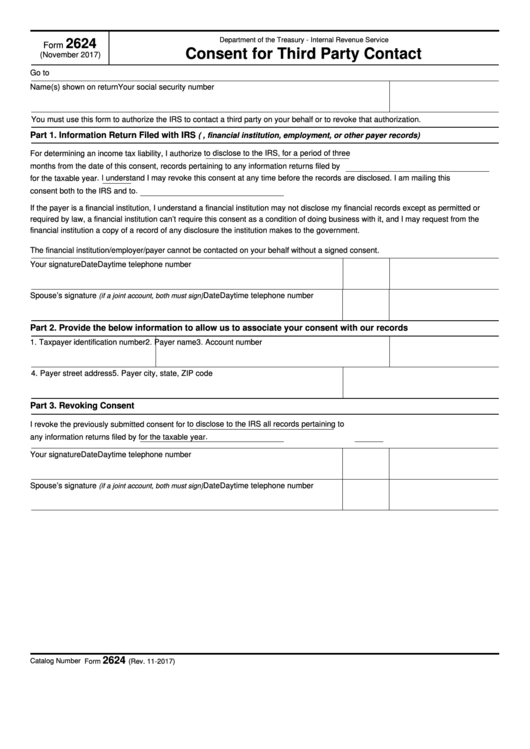

Department of the Treasury - Internal Revenue Service

2624

Form

Consent for Third Party Contact

(November 2017)

Go to for the latest information.

Name(s) shown on return

Your social security number

You must use this form to authorize the IRS to contact a third party on your behalf or to revoke that authorization.

Part 1. Information Return Filed with IRS

(e.g., financial institution, employment, or other payer records)

For determining an income tax liability, I authorize

to disclose to the IRS, for a period of three

months from the date of this consent, records pertaining to any information returns filed by

. I understand I may revoke this consent at any time before the records are disclosed. I am mailing this

for the taxable year

.

consent both to the IRS and to

If the payer is a financial institution, I understand a financial institution may not disclose my financial records except as permitted or

required by law, a financial institution can’t require this consent as a condition of doing business with it, and I may request from the

financial institution a copy of a record of any disclosure the institution makes to the government.

The financial institution/employer/payer cannot be contacted on your behalf without a signed consent.

Your signature

Date

Daytime telephone number

Spouse’s signature

Date

Daytime telephone number

(if a joint account, both must sign)

Part 2. Provide the below information to allow us to associate your consent with our records

1. Taxpayer identification number

2. Payer name

3. Account number

4. Payer street address

5. Payer city, state, ZIP code

Part 3. Revoking Consent

I revoke the previously submitted consent for

to disclose to the IRS all records pertaining to

any information returns filed by

for the taxable year

.

Your signature

Date

Daytime telephone number

Spouse’s signature

Date

Daytime telephone number

(if a joint account, both must sign)

2624

Catalog Number 18706T

Form

(Rev. 11-2017)

1

1 2

2