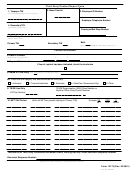

Instructions for Form 2624, Consent for Third Party Contact

Use the following information for completing Form 2624.

Before completing this form, you must first request corrected income statements or written verification of the correct amount of income

paid to you from the financial institution, employer, or payer. If you are unable to acquire the information, you may request the IRS to

contact the financial institution, employer, or payer on your behalf. For the IRS to take these actions, we require your consent.

Part 1 Information Return Filed with IRS

(e.g., financial institution, employment, or other payer records)

Complete the blank fields to provide the name of the financial institution, the employer, or other payer/debtor who reported the income

amount in question to the IRS and the tax year it was received.

Be sure the income recipient signs the consent form. If both you and your spouse are on the information document in question, you

both must sign. The financial institution/employer/payer cannot be contacted on your behalf without a signed consent.

EXAMPLE: For determining an income tax liability, I authorize Pine Bank to disclose to the IRS, for a period of three months from the

date of this consent, all records pertaining to any information returns filed by Pine Bank for the taxable year 2016. I understand I may

revoke this consent at any time before the records are disclosed. I am mailing this consent both to the IRS and to Pine Bank.

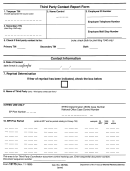

Part 2 Provide the below information to allow us to associate your consent with our records.

Line 1. Provide the taxpayer identification number/employer number for the information document in question.

Line 2. Provide the name of the third party in question.

Line 3. Provide the account number if available.

Line 4. Provide the street address for the third-party document in question.

Line 5. Provide the city, state, and zip code of the third-party document in question.

Part 3 Revoking consent

To revoke the previously submitted consent, complete the blank fields to provide the name of the financial institution, the employer, or

other payer/debtor who reported the income amount in question to the IRS and the tax year it was received. Be sure the income

recipient signs the consent form. If both you and your spouse are on the information document in question, you both must sign.

Return the signed Form 2624 to the IRS office listed on the most recent notice or letter you received.

2624

Catalog Number 18706T

Form

(Rev. 11-2017)

1

1 2

2