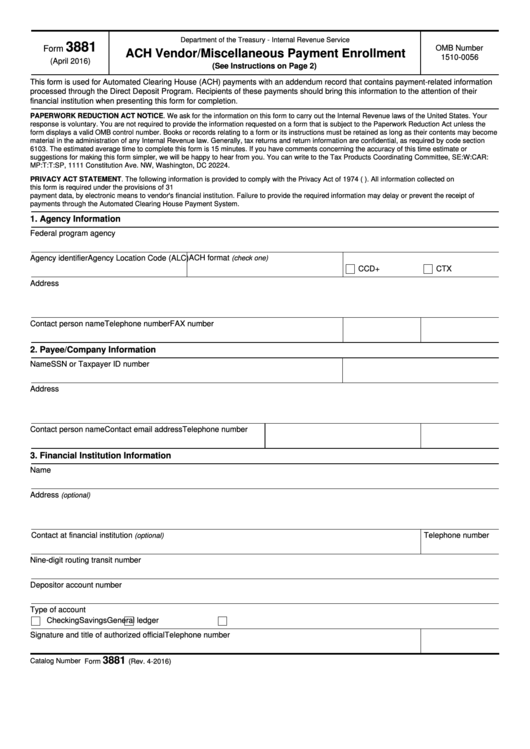

Department of the Treasury - Internal Revenue Service

3881

OMB Number

Form

ACH Vendor/Miscellaneous Payment Enrollment

1510-0056

(April 2016)

(See Instructions on Page 2)

This form is used for Automated Clearing House (ACH) payments with an addendum record that contains payment-related information

processed through the Direct Deposit Program. Recipients of these payments should bring this information to the attention of their

financial institution when presenting this form for completion.

PAPERWORK REDUCTION ACT NOTICE. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Your

response is voluntary. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the

form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become

material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by code section

6103. The estimated average time to complete this form is 15 minutes. If you have comments concerning the accuracy of this time estimate or

suggestions for making this form simpler, we will be happy to hear from you. You can write to the Tax Products Coordinating Committee, SE:W:CAR:

MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

PRIVACY ACT STATEMENT. The following information is provided to comply with the Privacy Act of 1974 (P.L. 93-579). All information collected on

this form is required under the provisions of 31 U.S.C. 3322 and 31 CFR 210. This information will be used by the Treasury Department to transmit

payment data, by electronic means to vendor's financial institution. Failure to provide the required information may delay or prevent the receipt of

payments through the Automated Clearing House Payment System.

1. Agency Information

Federal program agency

Agency identifier

Agency Location Code (ALC)

ACH format

(check one)

CCD+

CTX

Address

Contact person name

Telephone number

FAX number

2. Payee/Company Information

Name

SSN or Taxpayer ID number

Address

Contact person name

Contact email address

Telephone number

3. Financial Institution Information

Name

Address

(optional)

Contact at financial institution

Telephone number

(optional)

Nine-digit routing transit number

Depositor account number

Type of account

Checking

Savings

General ledger

Signature and title of authorized official

Telephone number

3881

Catalog Number 41140F

Form

(Rev. 4-2016)

1

1 2

2