Form 3881-A - Ach Vendor/miscellaneous Payment Enrollment - Hctc - 2017

ADVERTISEMENT

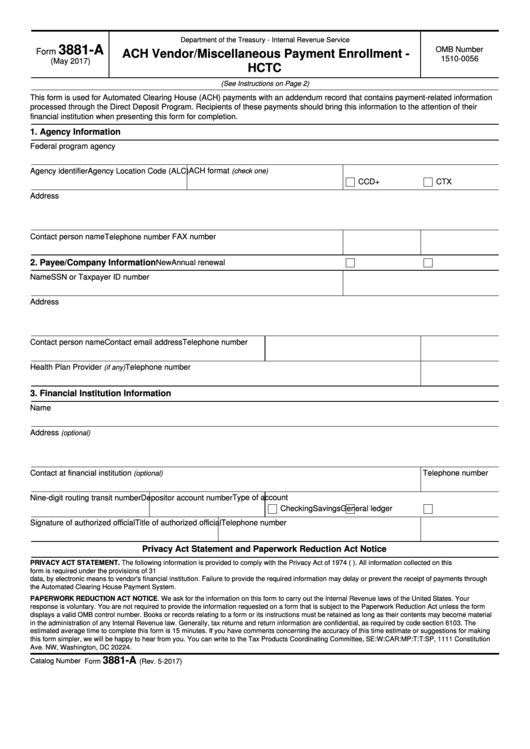

Department of the Treasury - Internal Revenue Service

3881-A

OMB Number

Form

ACH Vendor/Miscellaneous Payment Enrollment -

1510-0056

(May 2017)

HCTC

(See Instructions on Page 2)

This form is used for Automated Clearing House (ACH) payments with an addendum record that contains payment-related information

processed through the Direct Deposit Program. Recipients of these payments should bring this information to the attention of their

financial institution when presenting this form for completion.

1. Agency Information

Federal program agency

ACH format

Agency identifier

Agency Location Code (ALC)

(check one)

CCD+

CTX

Address

Contact person name

Telephone number

FAX number

2. Payee/Company Information

New

Annual renewal

Name

SSN or Taxpayer ID number

Address

Contact person name

Contact email address

Telephone number

Health Plan Provider

Telephone number

(if any)

3. Financial Institution Information

Name

Address

(optional)

Contact at financial institution

Telephone number

(optional)

Type of account

Nine-digit routing transit number

Depositor account number

Checking

Savings

General ledger

Signature of authorized official

Title of authorized official

Telephone number

Privacy Act Statement and Paperwork Reduction Act Notice

PRIVACY ACT STATEMENT. The following information is provided to comply with the Privacy Act of 1974 (P.L. 93-579). All information collected on this

form is required under the provisions of 31 U.S.C. 3322 and 31 CFR 210. This information will be used by the Treasury Department to transmit payment

data, by electronic means to vendor's financial institution. Failure to provide the required information may delay or prevent the receipt of payments through

the Automated Clearing House Payment System.

PAPERWORK REDUCTION ACT NOTICE. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Your

response is voluntary. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form

displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material

in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by code section 6103. The

estimated average time to complete this form is 15 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making

this form simpler, we will be happy to hear from you. You can write to the Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution

Ave. NW, Washington, DC 20224.

3881-A

Catalog Number 69576F

Form

(Rev. 5-2017)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2