Page 2

Instructions for Form 3881

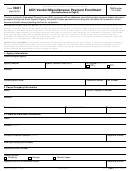

Automated Clearing House (ACH) Vendor/Miscellaneous Payment Enrollment

Internal Revenue Service to establish Automated Clearing House (ACH) payments, also referred to as Electronic Funds Transfers

(EFTs).

1. Agency Information Section

– Contains the name and address of the Federal program agency originating the vendor/

miscellaneous payment, agency identifier, agency location code, contact person name and telephone number of the agency and the

ACH format.

2. Payee/Company Information Section

– Print or type the name of the payee/company and address that will manage ACH

vendor/miscellaneous payments, social security or taxpayer ID number (may also be referred to as the employer identification number),

contact person and telephone number of the payee/company. Payee also verifies depositor account number and type of account

entered by your financial institution in the Financial Institution Information Section.

3. Financial Institution Information Section

– Print or type the name and address of the payee/company's financial institution

that will receive the ACH payment, ACH coordinator name and telephone number, nine-digit routing transit number, depositor (payee/

company) account number and type of account. Signature, title, and telephone number of the appropriate financial institution official is

included.

Note: If the designated Payee/Company contact person knows all of the requested bank information, the Payee/Company contact may

complete the Financial Institution Information Section. There is no requirement for a bank official signature.

Burden Estimate Statement

The estimated average burden associated with this collection of information is 15 minutes per respondent or record keeper, depending

on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden

should be directed to the Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave., NW, Washington, DC

20224 or the Office of Management and Budget, Paperwork Reduction Project (1510-0056), Washington, DC 20503.

3881

Catalog Number 41140F

Form

(Rev. 4-2016)

1

1 2

2