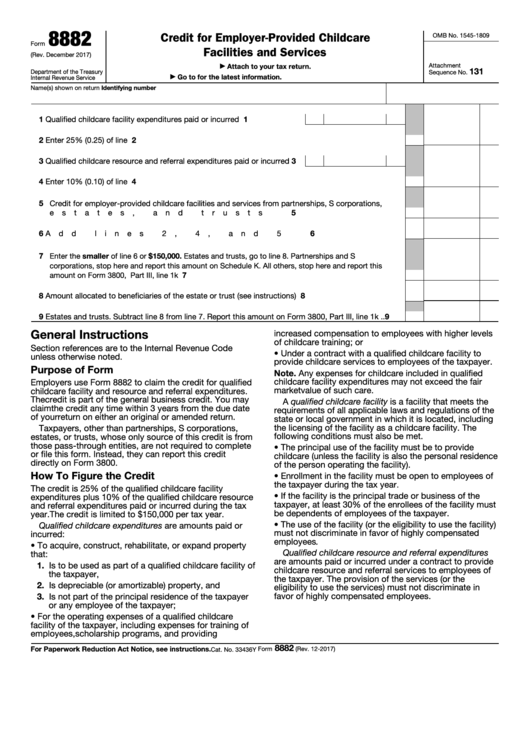

8882

Credit for Employer-Provided Childcare

OMB No. 1545-1809

Form

Facilities and Services

(Rev. December 2017)

Attachment

Attach to your tax return.

▶

131

Department of the Treasury

Sequence No.

Go to for the latest information.

Internal Revenue Service

▶

Name(s) shown on return

Identifying number

1 Qualified childcare facility expenditures paid or incurred .

1

.

.

.

.

2 Enter 25% (0.25) of line 1 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3 Qualified childcare resource and referral expenditures paid or incurred

3

4 Enter 10% (0.10) of line 3 .

4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5 Credit for employer-provided childcare facilities and services from partnerships, S corporations,

estates, and trusts

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6 Add lines 2, 4, and 5 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7 Enter the smaller of line 6 or $150,000. Estates and trusts, go to line 8. Partnerships and S

corporations, stop here and report this amount on Schedule K. All others, stop here and report this

7

amount on Form 3800, Part III, line 1k

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8 Amount allocated to beneficiaries of the estate or trust (see instructions)

8

.

.

.

.

.

.

.

.

.

9 Estates and trusts. Subtract line 8 from line 7. Report this amount on Form 3800, Part III, line 1k .

.

9

General Instructions

increased compensation to employees with higher levels

of childcare training; or

Section references are to the Internal Revenue Code

• Under a contract with a qualified childcare facility to

unless otherwise noted.

provide childcare services to employees of the taxpayer.

Purpose of Form

Note. Any expenses for childcare included in qualified

childcare facility expenditures may not exceed the fair

Employers use Form 8882 to claim the credit for qualified

market value of such care.

childcare facility and resource and referral expenditures.

The credit is part of the general business credit. You may

A qualified childcare facility is a facility that meets the

claim the credit any time within 3 years from the due date

requirements of all applicable laws and regulations of the

of your return on either an original or amended return.

state or local government in which it is located, including

the licensing of the facility as a childcare facility. The

Taxpayers, other than partnerships, S corporations,

following conditions must also be met.

estates, or trusts, whose only source of this credit is from

those pass-through entities, are not required to complete

• The principal use of the facility must be to provide

or file this form. Instead, they can report this credit

childcare (unless the facility is also the personal residence

directly on Form 3800.

of the person operating the facility).

How To Figure the Credit

• Enrollment in the facility must be open to employees of

the taxpayer during the tax year.

The credit is 25% of the qualified childcare facility

• If the facility is the principal trade or business of the

expenditures plus 10% of the qualified childcare resource

taxpayer, at least 30% of the enrollees of the facility must

and referral expenditures paid or incurred during the tax

be dependents of employees of the taxpayer.

year. The credit is limited to $150,000 per tax year.

• The use of the facility (or the eligibility to use the facility)

Qualified childcare expenditures are amounts paid or

must not discriminate in favor of highly compensated

incurred:

employees.

• To acquire, construct, rehabilitate, or expand property

Qualified childcare resource and referral expenditures

that:

are amounts paid or incurred under a contract to provide

1. Is to be used as part of a qualified childcare facility of

childcare resource and referral services to employees of

the taxpayer,

the taxpayer. The provision of the services (or the

2. Is depreciable (or amortizable) property, and

eligibility to use the services) must not discriminate in

3. Is not part of the principal residence of the taxpayer

favor of highly compensated employees.

or any employee of the taxpayer;

• For the operating expenses of a qualified childcare

facility of the taxpayer, including expenses for training of

employees, scholarship programs, and providing

8882

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2017)

Cat. No. 33436Y

1

1 2

2