Instructions For Form W-14 - Certificate Of Foreign Contracting Party Receiving Federal Procurement Payments

ADVERTISEMENT

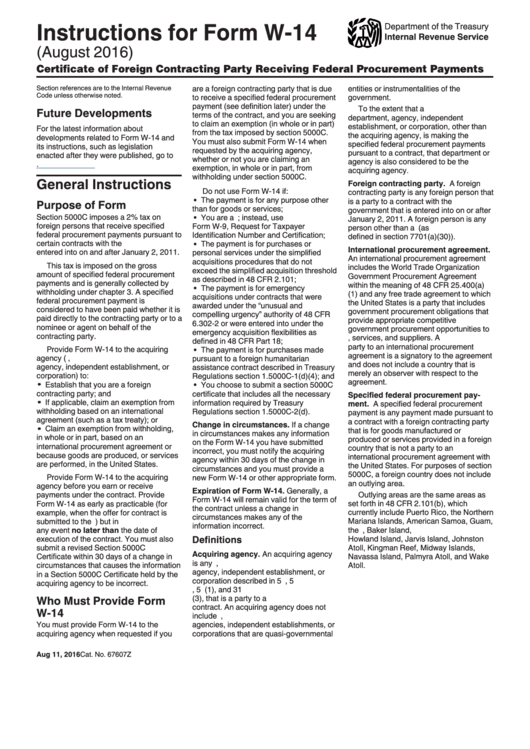

Instructions for Form W-14

Department of the Treasury

Internal Revenue Service

(August 2016)

Certificate of Foreign Contracting Party Receiving Federal Procurement Payments

Section references are to the Internal Revenue

are a foreign contracting party that is due

entities or instrumentalities of the U.S.

Code unless otherwise noted.

to receive a specified federal procurement

government.

payment (see definition later) under the

To the extent that a U.S. government

Future Developments

terms of the contract, and you are seeking

department, agency, independent

to claim an exemption (in whole or in part)

establishment, or corporation, other than

For the latest information about

from the tax imposed by section 5000C.

the acquiring agency, is making the

developments related to Form W-14 and

You must also submit Form W-14 when

specified federal procurement payments

its instructions, such as legislation

requested by the acquiring agency,

pursuant to a contract, that department or

enacted after they were published, go to

whether or not you are claiming an

agency is also considered to be the

exemption, in whole or in part, from

acquiring agency.

withholding under section 5000C.

General Instructions

Foreign contracting party. A foreign

Do not use Form W-14 if:

contracting party is any foreign person that

The payment is for any purpose other

is a party to a contract with the U.S.

Purpose of Form

than for goods or services;

government that is entered into on or after

Section 5000C imposes a 2% tax on

You are a U.S. person; instead, use

January 2, 2011. A foreign person is any

foreign persons that receive specified

Form W-9, Request for Taxpayer

person other than a U.S. person (as

federal procurement payments pursuant to

Identification Number and Certification;

defined in section 7701(a)(30)).

certain contracts with the U.S. government

The payment is for purchases or

International procurement agreement.

entered into on and after January 2, 2011.

personal services under the simplified

An international procurement agreement

acquisitions procedures that do not

This tax is imposed on the gross

includes the World Trade Organization

exceed the simplified acquisition threshold

amount of specified federal procurement

Government Procurement Agreement

as described in 48 CFR 2.101;

payments and is generally collected by

within the meaning of 48 CFR 25.400(a)

The payment is for emergency

withholding under chapter 3. A specified

(1) and any free trade agreement to which

acquisitions under contracts that were

federal procurement payment is

the United States is a party that includes

awarded under the “unusual and

considered to have been paid whether it is

government procurement obligations that

compelling urgency” authority of 48 CFR

paid directly to the contracting party or to a

provide appropriate competitive

6.302-2 or were entered into under the

nominee or agent on behalf of the

government procurement opportunities to

emergency acquisition flexibilities as

contracting party.

U.S. goods, services, and suppliers. A

defined in 48 CFR Part 18;

party to an international procurement

Provide Form W-14 to the acquiring

The payment is for purchases made

agreement is a signatory to the agreement

agency (U.S. government department,

pursuant to a foreign humanitarian

and does not include a country that is

agency, independent establishment, or

assistance contract described in Treasury

merely an observer with respect to the

corporation) to:

Regulations section 1.5000C-1(d)(4); and

agreement.

Establish that you are a foreign

You choose to submit a section 5000C

contracting party; and

certificate that includes all the necessary

Specified federal procurement pay-

If applicable, claim an exemption from

information required by Treasury

ment. A specified federal procurement

withholding based on an international

Regulations section 1.5000C-2(d).

payment is any payment made pursuant to

agreement (such as a tax treaty); or

a contract with a foreign contracting party

Change in circumstances. If a change

Claim an exemption from withholding,

that is for goods manufactured or

in circumstances makes any information

in whole or in part, based on an

produced or services provided in a foreign

on the Form W-14 you have submitted

international procurement agreement or

country that is not a party to an

incorrect, you must notify the acquiring

because goods are produced, or services

international procurement agreement with

agency within 30 days of the change in

are performed, in the United States.

the United States. For purposes of section

circumstances and you must provide a

5000C, a foreign country does not include

Provide Form W-14 to the acquiring

new Form W-14 or other appropriate form.

an outlying area.

agency before you earn or receive

Expiration of Form W-14. Generally, a

Outlying areas are the same areas as

payments under the contract. Provide

Form W-14 will remain valid for the term of

set forth in 48 CFR 2.101(b), which

Form W-14 as early as practicable (for

the contract unless a change in

example, when the offer for contract is

currently include Puerto Rico, the Northern

circumstances makes any of the

submitted to the U.S. government) but in

Mariana Islands, American Samoa, Guam,

information incorrect.

any event no later than the date of

the U.S. Virgin Islands, Baker Island,

Definitions

execution of the contract. You must also

Howland Island, Jarvis Island, Johnston

Atoll, Kingman Reef, Midway Islands,

submit a revised Section 5000C

Acquiring agency. An acquiring agency

Navassa Island, Palmyra Atoll, and Wake

Certificate within 30 days of a change in

is any U.S. government department,

circumstances that causes the information

Atoll.

agency, independent establishment, or

in a Section 5000C Certificate held by the

corporation described in 5 U.S.C. 101, 5

acquiring agency to be incorrect.

U.S.C. 102, 5 U.S.C. 104(1), and 31

Who Must Provide Form

U.S.C. 9101(3), that is a party to a

contract. An acquiring agency does not

W-14

include U.S. government departments,

You must provide Form W-14 to the

agencies, independent establishments, or

acquiring agency when requested if you

corporations that are quasi-governmental

Aug 11, 2016

Cat. No. 67607Z

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3