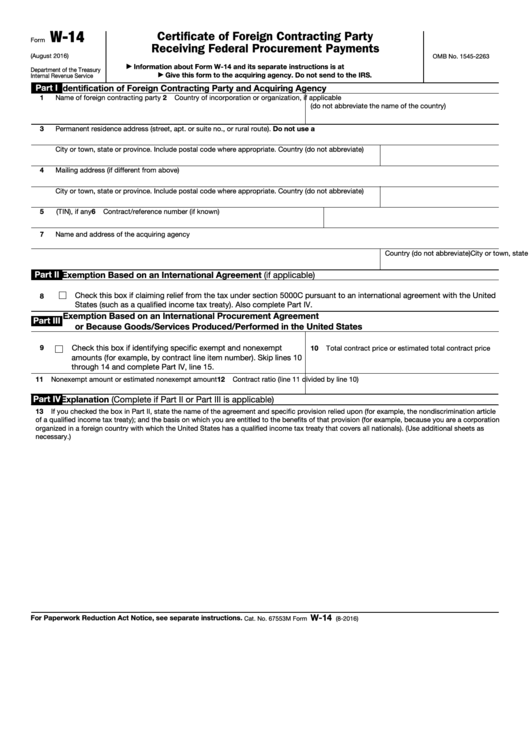

W-14

Certificate of Foreign Contracting Party

Form

Receiving Federal Procurement Payments

(August 2016)

OMB No. 1545-2263

Information about Form W-14 and its separate instructions is at

▶

Department of the Treasury

Give this form to the acquiring agency. Do not send to the IRS.

Internal Revenue Service

▶

Part I

Identification of Foreign Contracting Party and Acquiring Agency

1

Name of foreign contracting party

2

Country of incorporation or organization, if applicable

(do not abbreviate the name of the country)

3

Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address.

City or town, state or province. Include postal code where appropriate.

Country (do not abbreviate)

4

Mailing address (if different from above)

City or town, state or province. Include postal code where appropriate.

Country (do not abbreviate)

5

6

U.S. taxpayer identification number (TIN), if any

Contract/reference number (if known)

7

Name and address of the acquiring agency

City or town, state or province. Include postal code where appropriate.

Country (do not abbreviate)

Part II

Exemption Based on an International Agreement (if applicable)

Check this box if claiming relief from the tax under section 5000C pursuant to an international agreement with the United

8

States (such as a qualified income tax treaty). Also complete Part IV.

Exemption Based on an International Procurement Agreement

Part III

or Because Goods/Services Produced/Performed in the United States

Check this box if identifying specific exempt and nonexempt

9

10

Total contract price or estimated total contract price

amounts (for example, by contract line item number). Skip lines 10

through 14 and complete Part IV, line 15.

11

Nonexempt amount or estimated nonexempt amount

12

Contract ratio (line 11 divided by line 10)

Part IV

Explanation (Complete if Part II or Part III is applicable)

13

If you checked the box in Part II, state the name of the agreement and specific provision relied upon (for example, the nondiscrimination article

of a qualified income tax treaty); and the basis on which you are entitled to the benefits of that provision (for example, because you are a corporation

organized in a foreign country with which the United States has a qualified income tax treaty that covers all nationals). (Use additional sheets as

necessary.)

W-14

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 67553M

Form

(8-2016)

1

1 2

2