Instructions For Form W-7-A - Application For Taxpayer Identification Number For Pending U.s. Adoptions

ADVERTISEMENT

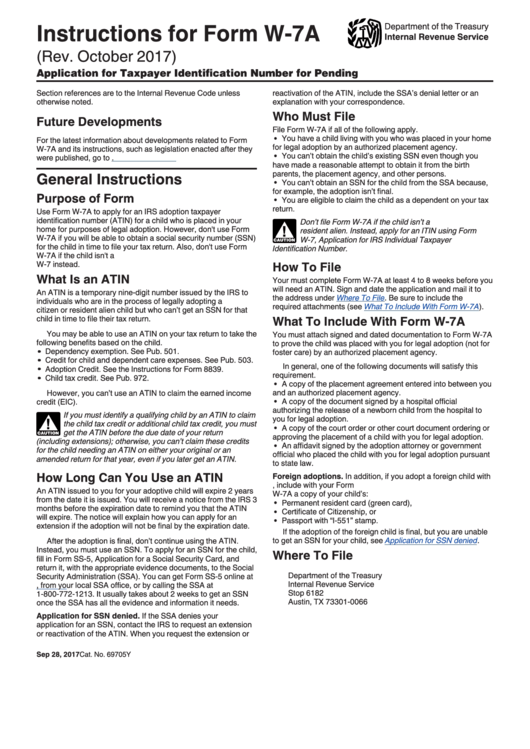

Instructions for Form W-7A

Department of the Treasury

Internal Revenue Service

(Rev. October 2017)

Application for Taxpayer Identification Number for Pending U.S. Adoptions

Section references are to the Internal Revenue Code unless

reactivation of the ATIN, include the SSA’s denial letter or an

otherwise noted.

explanation with your correspondence.

Who Must File

Future Developments

File Form W-7A if all of the following apply.

You have a child living with you who was placed in your home

For the latest information about developments related to Form

for legal adoption by an authorized placement agency.

W-7A and its instructions, such as legislation enacted after they

You can’t obtain the child’s existing SSN even though you

were published, go to IRS.gov/FormW7A.

have made a reasonable attempt to obtain it from the birth

General Instructions

parents, the placement agency, and other persons.

You can’t obtain an SSN for the child from the SSA because,

for example, the adoption isn’t final.

Purpose of Form

You are eligible to claim the child as a dependent on your tax

return.

Use Form W-7A to apply for an IRS adoption taxpayer

identification number (ATIN) for a child who is placed in your

Don’t file Form W-7A if the child isn’t a U.S. citizen or

home for purposes of legal adoption. However, don't use Form

resident alien. Instead, apply for an ITIN using Form

!

W-7A if you will be able to obtain a social security number (SSN)

W-7, Application for IRS Individual Taxpayer

CAUTION

for the child in time to file your tax return. Also, don't use Form

Identification Number.

W-7A if the child isn't a U.S. citizen or resident alien. Use Form

How To File

W-7 instead.

What Is an ATIN

Your must complete Form W-7A at least 4 to 8 weeks before you

will need an ATIN. Sign and date the application and mail it to

An ATIN is a temporary nine-digit number issued by the IRS to

the address under

Where To

File. Be sure to include the

individuals who are in the process of legally adopting a U.S.

required attachments (see

What To Include With Form

W-7A).

citizen or resident alien child but who can’t get an SSN for that

What To Include With Form W-7A

child in time to file their tax return.

You may be able to use an ATIN on your tax return to take the

You must attach signed and dated documentation to Form W-7A

following benefits based on the child.

to prove the child was placed with you for legal adoption (not for

Dependency exemption. See Pub. 501.

foster care) by an authorized placement agency.

Credit for child and dependent care expenses. See Pub. 503.

In general, one of the following documents will satisfy this

Adoption Credit. See the Instructions for Form 8839.

requirement.

Child tax credit. See Pub. 972.

A copy of the placement agreement entered into between you

and an authorized placement agency.

However, you can’t use an ATIN to claim the earned income

A copy of the document signed by a hospital official

credit (EIC).

authorizing the release of a newborn child from the hospital to

If you must identify a qualifying child by an ATIN to claim

you for legal adoption.

the child tax credit or additional child tax credit, you must

!

A copy of the court order or other court document ordering or

get the ATIN before the due date of your return

approving the placement of a child with you for legal adoption.

CAUTION

(including extensions); otherwise, you can’t claim these credits

An affidavit signed by the adoption attorney or government

for the child needing an ATIN on either your original or an

official who placed the child with you for legal adoption pursuant

amended return for that year, even if you later get an ATIN.

to state law.

How Long Can You Use an ATIN

Foreign adoptions. In addition, if you adopt a foreign child with

U.S. citizenship or resident alien status, include with your Form

An ATIN issued to you for your adoptive child will expire 2 years

W-7A a copy of your child’s:

from the date it is issued. You will receive a notice from the IRS 3

Permanent resident card (green card),

months before the expiration date to remind you that the ATIN

Certificate of Citizenship, or

will expire. The notice will explain how you can apply for an

Passport with “I-551” stamp.

extension if the adoption will not be final by the expiration date.

If the adoption of the foreign child is final, but you are unable

to get an SSN for your child, see

Application for SSN

denied.

After the adoption is final, don’t continue using the ATIN.

Instead, you must use an SSN. To apply for an SSN for the child,

Where To File

fill in Form SS-5, Application for a Social Security Card, and

return it, with the appropriate evidence documents, to the Social

Department of the Treasury

Security Administration (SSA). You can get Form SS-5 online at

Internal Revenue Service

SSA.gov, from your local SSA office, or by calling the SSA at

Stop 6182

1-800-772-1213. It usually takes about 2 weeks to get an SSN

Austin, TX 73301-0066

once the SSA has all the evidence and information it needs.

Application for SSN denied. If the SSA denies your

application for an SSN, contact the IRS to request an extension

or reactivation of the ATIN. When you request the extension or

Sep 28, 2017

Cat. No. 69705Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2