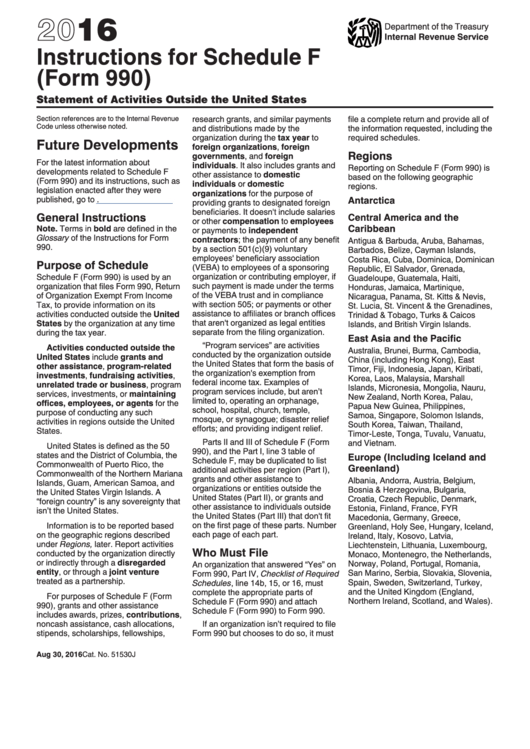

Instructions For Schedule F (Form 990) - Statement Of Activities Outside The United States - 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Schedule F

(Form 990)

Statement of Activities Outside the United States

Section references are to the Internal Revenue

research grants, and similar payments

file a complete return and provide all of

Code unless otherwise noted.

and distributions made by the

the information requested, including the

organization during the tax year to

required schedules.

Future Developments

foreign organizations, foreign

Regions

governments, and foreign

For the latest information about

individuals. It also includes grants and

Reporting on Schedule F (Form 990) is

developments related to Schedule F

other assistance to domestic

based on the following geographic

(Form 990) and its instructions, such as

individuals or domestic

regions.

legislation enacted after they were

organizations for the purpose of

published, go to

Antarctica

providing grants to designated foreign

beneficiaries. It doesn't include salaries

General Instructions

Central America and the

or other compensation to employees

Caribbean

Note. Terms in bold are defined in the

or payments to independent

Glossary of the Instructions for Form

contractors; the payment of any benefit

Antigua & Barbuda, Aruba, Bahamas,

990.

by a section 501(c)(9) voluntary

Barbados, Belize, Cayman Islands,

employees' beneficiary association

Costa Rica, Cuba, Dominica, Dominican

Purpose of Schedule

(VEBA) to employees of a sponsoring

Republic, El Salvador, Grenada,

organization or contributing employer, if

Schedule F (Form 990) is used by an

Guadeloupe, Guatemala, Haiti,

such payment is made under the terms

organization that files Form 990, Return

Honduras, Jamaica, Martinique,

of the VEBA trust and in compliance

of Organization Exempt From Income

Nicaragua, Panama, St. Kitts & Nevis,

with section 505; or payments or other

Tax, to provide information on its

St. Lucia, St. Vincent & the Grenadines,

assistance to affiliates or branch offices

activities conducted outside the United

Trinidad & Tobago, Turks & Caicos

that aren't organized as legal entities

States by the organization at any time

Islands, and British Virgin Islands.

separate from the filing organization.

during the tax year.

East Asia and the Pacific

“Program services” are activities

Activities conducted outside the

Australia, Brunei, Burma, Cambodia,

conducted by the organization outside

United States include grants and

China (including Hong Kong), East

the United States that form the basis of

other assistance, program-related

Timor, Fiji, Indonesia, Japan, Kiribati,

the organization's exemption from

investments, fundraising activities,

Korea, Laos, Malaysia, Marshall

federal income tax. Examples of

unrelated trade or business, program

Islands, Micronesia, Mongolia, Nauru,

program services include, but aren’t

services, investments, or maintaining

New Zealand, North Korea, Palau,

limited to, operating an orphanage,

offices, employees, or agents for the

Papua New Guinea, Philippines,

school, hospital, church, temple,

purpose of conducting any such

Samoa, Singapore, Solomon Islands,

mosque, or synagogue; disaster relief

activities in regions outside the United

South Korea, Taiwan, Thailand,

efforts; and providing indigent relief.

States.

Timor-Leste, Tonga, Tuvalu, Vanuatu,

Parts II and III of Schedule F (Form

and Vietnam.

United States is defined as the 50

990), and the Part I, line 3 table of

states and the District of Columbia, the

Europe (Including Iceland and

Schedule F, may be duplicated to list

Commonwealth of Puerto Rico, the

Greenland)

additional activities per region (Part I),

Commonwealth of the Northern Mariana

grants and other assistance to

Albania, Andorra, Austria, Belgium,

Islands, Guam, American Samoa, and

organizations or entities outside the

Bosnia & Herzegovina, Bulgaria,

the United States Virgin Islands. A

United States (Part II), or grants and

Croatia, Czech Republic, Denmark,

“foreign country” is any sovereignty that

other assistance to individuals outside

Estonia, Finland, France, FYR

isn’t the United States.

the United States (Part III) that don't fit

Macedonia, Germany, Greece,

on the first page of these parts. Number

Information is to be reported based

Greenland, Holy See, Hungary, Iceland,

each page of each part.

on the geographic regions described

Ireland, Italy, Kosovo, Latvia,

under Regions, later. Report activities

Liechtenstein, Lithuania, Luxembourg,

Who Must File

conducted by the organization directly

Monaco, Montenegro, the Netherlands,

or indirectly through a disregarded

Norway, Poland, Portugal, Romania,

An organization that answered “Yes” on

entity, or through a joint venture

San Marino, Serbia, Slovakia, Slovenia,

Form 990, Part IV, Checklist of Required

treated as a partnership.

Spain, Sweden, Switzerland, Turkey,

Schedules, line 14b, 15, or 16, must

and the United Kingdom (England,

complete the appropriate parts of

For purposes of Schedule F (Form

Northern Ireland, Scotland, and Wales).

Schedule F (Form 990) and attach

990), grants and other assistance

Schedule F (Form 990) to Form 990.

includes awards, prizes, contributions,

noncash assistance, cash allocations,

If an organization isn’t required to file

stipends, scholarships, fellowships,

Form 990 but chooses to do so, it must

Aug 30, 2016

Cat. No. 51530J

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5