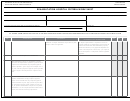

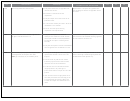

Form Cms-437a - Rehab Unit Criteria Worksheet Page 6

ADVERTISEMENT

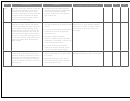

THE HOSPITAL REPRESENTATIVE WHO

TAG

REGULATION

GUIDANCE

YES

NO

N/A

COMPLETES THIS ENTIRE FORM

A3513

(2) New IRF beds. Any IRF beds that are added

• If the hospital added beds to its IRF unit, the

• The representative verifies that the hospital

to an existing IRF must meet all applicable State

surveyor or CMS will verify that the hospital had

received State approval (certification of need or

Certificate of Need and State licensure laws. New

approval (certificate of need or State license )

State licensure) , if prior approval is required by

IRF beds may be added one time at any point during

before adding beds, if such approval is required.

the State, prior to any IRF unit bed increase.

a cost reporting period and will be considered

• The surveyor must verify that the hospital

• The representative verifies that the hospital

new for the rest of that cost reporting period. A

received written CMS RO approval before

received written approval from the CMS RO

full 12-month cost reporting period must elapse

adding any new beds to its IRF unit.

before any new beds were added to the IRF

between the delicensing or decertification of IRF

unit.

beds in an IRF hospital or IRF unit and the addition

• The surveyor will verify that the hospital’s IRF

of new IRF beds to that IRF hospital or IRF unit.

unit didn’t have more than one increase in beds

• The representative will verify that if the

Before an IRF can add new beds, it must receive

during a single cost reporting period.

hospital’s IRF unit decreased beds, it didn’t

written approval from the appropriate CMS RO, so

thereafter add beds unless a full 12 month cost

that the RO can verify that a full 12-month cost

• Surveyors must verify that if the hospital’s IRF

reporting period had elapsed.

reporting period has elapsed since the IRF has had

unit decreased beds, it didn’t thereafter add

beds declincensed or decertified. New IRF beds are

beds unless a full 12 month cost reporting

• The representative will verify that the hospital’s

included in the compliance review calculations

period had elapsed.

IRF unit didn’t have more than one increase in

under paragraph (b) of this section from the time

beds during a single cost reporting period.

that they are added to the IRF.

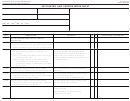

A3514

(3) Change of ownership or leasing.

• IRF status is lost if a hospital is acquired and the

The representative of the IRF unit, that has

An IRF hospital or IRF unit that

new owners reject assignment of the previous

undergone a change of ownership, must ensure

undergoes a change of ownership, or

owner’s Medicare provider assignment.

that the new owner(s) have accepted assignment

leasing as defined in § 489.18 of this

of the previous Medicare provider agreement. If the

• Only entire hospitals may be sold or leased.

chapter, retains its excluded status

new owner(s) have not accepted the assignment,

and will continue to be paid under

the representative cannot request continued

• IRF units may not be sold or leased separately

the prospective payment systems

participation as an IPPS-excluded unit.

from the hospital of which it is a part.

specified in § 412.1(a)(3) before and

after the change of ownership or

leasing if the new owner(s) of the IRF

accept assignment of the previous

owners’ Medicare provider agreement

and the IRF continues to meet all the

requirements for payment under the IRF

prospective payment system. If the new

owner(s) do not accept assignment of

the previous owners’ Medicare provider

agreement, the IRF is considered to be

voluntarily terminated and the new

owner(s) may reapply to participate

in the Medicare program. If the IRF

does not continue to meet all of

the requirements under the new IRF

prospective payment system, then the

IRF loses its excluded status and is paid

according to the prospective payment

systems described in § 412.1(a)(1).

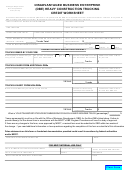

Form CMS-437A (06/12)

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9