950617

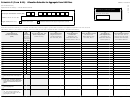

Schedule R (Form 941) (Rev. 1-2017)

Section references are to the Internal Revenue Code unless otherwise

Column a. The client’s EIN.

noted.

Column b (CPEO Use Only). Type of wages, tips, and other

compensation. Enter a code to report the type of wages, tips, and other

Future Developments

compensation paid to the individual(s) performing services for the client.

For the latest information about developments related to Schedule R

If you paid more than one type of wages, tips, or other compensation,

and its instructions, such as legislation enacted after they were

you must use more than one line to report for that client and enter the

published, go to

applicable code for each line. The following three codes are the only

entries that can be made in column b.

What’s New

• A: Wages, tips, and other compensation paid under section 3511(a).

A certified professional employer organization (CPEO) must attach

• B: Wages, tips, and other compensation paid under section 3511(c).

Schedule R to its aggregate Form 941, Employer’s QUARTERLY Federal

Tax Return.

• C: Wages, tips, and other compensation not reported under Code A or

Code B that are paid as an agent under Regulations section 31.3504-1

General Instructions

or a payor under a service agreement described in Regulations section

31.3504-2(b)(2).

Purpose of Schedule R

Column c. Wages, tips, and other compensation allocated to the listed

client EIN from Form 941, line 2.

Use Schedule R to allocate the aggregate information reported on Form

941 to each client. For purposes of Schedule R, the term “client” means

Column d. Total income tax withheld from wages, tips, and other

(a) an “employer or payer” identified on the Form 2678, Employer/Payer

compensation allocated to the listed client EIN from Form 941, line 3.

Appointment of Agent; (b) a customer who enters into a contract that

Column e. Total social security and Medicare taxes allocated to the

meets the requirements under section 7705(e)(2); or (c) a client who

listed client EIN from Form 941, line 5e. This amount includes Additional

enters into a service agreement described under Regulations section

Medicare Tax withholding.

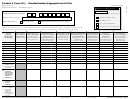

31.3504-2(b)(2) with a CPEO. If you have more than 10 clients, complete

as many continuation sheets as necessary. Attach Schedule R, including

Column f. Section 3121(q) Notice and Demand—Tax due on unreported

any continuation sheets, to your aggregate Form 941.

tips allocated to the listed client EIN from Form 941, line 5f.

Who Must File?

Column g. Qualified small business payroll tax credit for increasing

research activities allocated to the listed client EIN from Form 941, line

Agents approved by the IRS under section 3504 and CPEOs must

11. You must attach a separate Form 8974 for each client claiming this

complete Schedule R each time they file an aggregate Form 941. To

credit.

request approval to act as an agent for an employer under section 3504,

Column h. Total taxes after adjustments and credits allocated to the

the agent must file Form 2678 with the IRS. Form 2678 must be

listed client EIN from Form 941, line 12.

previously filed and approved by the IRS before filing Schedule R. To

become a CPEO, the organization must apply through the IRS Online

Column i. Total deposits from Form 941, line 13, plus any payments

Registration System. Visit the IRS website at for more

made with the return allocated to the listed client EIN.

information.

You must also report the same information for your employees on

When Must You File?

Schedule R, line 13.

Compare the total of each column on Schedule R, line 14 (including

If you are an aggregate Form 941 filer, file Schedule R with your

your information on line 13), to the amounts reported on the aggregate

aggregate Form 941 every quarter. Agents may file Form 941 and

Form 941. For each column total of Schedule R, the relevant line from

Schedule R electronically or by paper submission. CPEOs generally

Form 941 is noted in the column heading.

must file Form 941 and Schedule R electronically. For more information

about a CPEO's requirement to file electronically, see Rev. Proc.

The totals on Schedule R, line 14, must match the totals on Form 941.

2017-14, 2017-3 I.R.B. 426, available at

If the totals don't match, there is an error that must be corrected before

ar14.html.

submitting Form 941 and Schedule R.

Specific Instructions

Paperwork Reduction Act Notice. We ask for the information on

Schedule R to carry out the Internal Revenue laws of the United States.

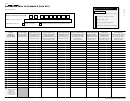

Completing Schedule R

You are required to give us this information. We need it to ensure that

you are complying with these laws and to allow us to figure and collect

Enter Your Business Information

the right amount of tax.

Carefully enter your EIN and the name of your business at the top of the

You aren't required to provide the information requested on a form

schedule. Make sure they exactly match the EIN and name shown on

that is subject to the Paperwork Reduction Act unless the form displays

the attached Form 941. Check one of the “Type of filer” boxes to tell us

a valid OMB control number. Books or records relating to a form or its

if you are a section 3504 agent or a CPEO.

instructions must be retained as long as their contents may become

material in the administration of any Internal Revenue law. Generally, tax

Calendar Year

returns and return information are confidential, as required by section

Enter the calendar year that applies to the quarter checked.

6103.

The time needed to complete and file Schedule R will vary depending

Check the Box for the Quarter

on individual circumstances. The estimated average time is:

Check the appropriate box of the quarter for which you are filing

Recordkeeping

.

.

.

.

.

.

.

.

.

.

.

. 12 hr., 26 min.

Schedule R. Make sure the quarter checked on the top of the

Schedule R matches the quarter checked on the attached Form 941.

Learning about the law or the form .

.

.

.

.

.

.

. 12 min.

Preparing, copying, and assembling the form .

.

.

.

. 24 min.

Client and Employee Information

If you have comments concerning the accuracy of these time

On Schedule R, including any continuation sheets, you must report the

estimates or suggestions for making Schedule R simpler, we would be

following for each client.

happy to hear from you. You can send us comments from

Note: When entering amounts over 999.99 on Schedule R, don't enter

formcomment. Or you can send your comments to Internal Revenue

commas.

Service, Tax Forms and Publications Division, 1111 Constitution Ave.

NW, IR-6526, Washington, DC 20224. Don't send Schedule R to this

address. Instead, see Where Should You File? in the Instructions for

Form 941.

1

1 2

2 3

3