3

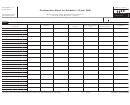

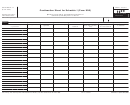

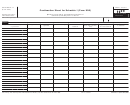

Schedule I (Form 990) (2017)

Page

Section references are to the Internal Revenue

Parts II and III of this schedule may be

Column (a). Enter the full legal name and

Code unless otherwise noted.

duplicated to list additional grantees (Part II)

mailing address of each recipient organization

or types of grants/assistance (Part III) that

or government entity.

General Instructions

don’t fit on the first page of these parts.

Column (b). Enter the employer

Number each page of each part.

identification number (EIN) of the grant

Future developments. For the latest

Don’t report on this schedule foreign grants

recipient.

information about developments related to

or assistance, including grants or assistance

Column (c). Enter the section of the

Schedule I (Form 990), such as legislation

provided to domestic organizations,

enacted after the schedule and its instructions

Internal Revenue Code under which the

domestic governments, or domestic

were published, go to

organization receiving the assistance is

individuals for the purpose of providing

tax-exempt, if applicable (for example, a

Note. Terms in bold are defined in the

grants or other assistance to a designated

school described in section 501(c)(3) or a

Glossary of the Instructions for Form 990.

foreign organization, foreign government,

social club described in section 501(c)(7)). If a

or foreign individual. Instead, report them on

Purpose of Schedule

recipient is a government entity, enter the

Schedule F (Form 990), Statement of

name of the government entity. If a recipient

Schedule I (Form 990) is used by an

Activities Outside the United States.

is neither a tax-exempt nor a government

organization that files Form 990 to provide

entity, leave column (c) blank.

Who Must File

information on grants and other assistance

Column (d). Enter the total dollar amount of

made by the filing organization during the tax

An organization that answered “Yes” on

cash grants to each recipient organization or

year to domestic organizations, domestic

Form 990, Part IV, Checklist of Required

entity for the tax year. Cash grants include

governments, and domestic individuals.

Schedules, line 21 or 22, must complete Part I

grants and allocations paid by cash, check,

Report activities conducted by the

and either Part II or Part III of this schedule

money order, electronic fund or wire transfer,

organization directly. Also, report activities

and attach it to Form 990.

and other charges against funds on deposit at

conducted by the organization indirectly

If an organization isn’t required to file Form

a financial institution.

through a disregarded entity or a joint

990 but chooses to do so, it must file a

venture treated as a partnership.

Columns (e) and (f). Enter the fair market

complete return and provide all of the

value of noncash property. Describe the

Grants and other assistance include

information requested, including the required

method of valuation. Report property with a

awards, prizes, contributions, noncash

schedules.

readily determinable market value (for

assistance, cash allocations, stipends,

example, market quotations for securities) at

scholarships, fellowships, research grants,

Specific Instructions

its fair market value. For marketable securities

and similar payments and distributions made

registered and listed on a recognized

by the organization during the tax year. For

Part I. General Information on

securities exchange, measure market value

purposes of Schedule I, grants and other

Grants and Assistance

on the date the property is distributed to the

assistance don’t include:

grantee by the average of the highest and

Complete this part if the organization

• Salaries or other compensation to

lowest quoted selling prices or the average

answered “Yes” on Form 990, Part IV, line 21

employees, or payments to independent

between the bona fide bid and asked prices.

or 22.

contractors if the primary purpose of such

When fair market value cannot be readily

payments is to serve the direct and immediate

Lines 1 and 2. On line 1, indicate “Yes” or

determined, use an appraised or estimated

needs of the organization (such as legal,

“No” regarding whether the organization

value.

accounting, or fundraising services).

maintains records to substantiate amounts,

Column (g). For noncash property or

eligibility, and selection criteria used for

• The payment of any benefit by a 501(c)(9)

assistance, enter a description of the property

grants. In general terms, describe how the

voluntary employees’ beneficiary association

or assistance. List all that apply. Examples of

organization monitors its grants to ensure that

(VEBA) to employees of a sponsoring

noncash assistance include medical supplies

such grants are used for proper purposes and

organization or contributing employer, if such

or equipment, pharmaceuticals, blankets, and

aren’t otherwise diverted from the intended

payment is made under the terms of the

books or other educational supplies.

use. For example, the organization can

VEBA trust and in compliance with section

describe the periodic reports required or field

Column (h). Describe the purpose or

505.

investigations conducted. Use Part IV for the

ultimate use of the grant funds or other

• Grants to affiliates that aren’t organized as

organization’s narrative response to line 2.

assistance. Don’t use general terms such as

legal entities separate from the filing

charitable, educational, religious, or scientific.

organization, or payments made to branch

Part II. Grants and Other

Use more specific descriptions such as

offices, accounts, or employees of the

Assistance to Domestic

general support, payments for nursing

organization located in the United States.

services, or laboratory construction. Enter the

Organizations and Domestic

A domestic organization includes a

type of assistance, such as medical, dental, or

Governments

corporation or partnership created or

free care for indigent hospital patients. In the

organized in the United States or under the

Line 1. Complete line 1 if the organization

case of disaster assistance, include a

law of the United States or of any state or

answered “Yes” on Form 990, Part IV, line 21.

description of the disaster and the assistance

possession. A trust is a domestic organization

A “Yes” response means that the organization

provided (for example, “Food, shelter, and

if a court within the United States or a U.S.

reported more than $5,000 on Form 990, Part

clothing for Organization A’s assistance to

possession is able to exercise primary

IX, line 1, column (A). Enter information only

victims of Colorado wildfires”). Use Part IV if

supervision over the administration of the

for each recipient domestic organization or

additional space is needed for descriptions.

trust, and one or more U.S. persons (or

domestic government that received more

If the organization checks

persons in U.S. possessions) have the

than $5,000 aggregate of grants or assistance

“Accrual” on Form 990, Part XII,

TIP

authority to control all substantial decisions of

from the organization during the tax year.

line 1; follows SFAS 116 (ASC

the trust.

Enter the details of each organization or

958) (see instructions for Form

A domestic government is a state, a U.S.

entity on a separate line of Part II. If there are

990, Part IX); and makes a grant during the

possession, a political subdivision of a state

more organizations or entities to report in Part

tax year to be paid in future years to a

or U.S. possession, the United States, or the

II than space available, report the additional

domestic organization or domestic

District of Columbia. A grant to a U.S.

organizations or entities on duplicate copies

government, it should report the grant’s

government agency must be included on this

of Part II. Use as many duplicate copies as

present value in Part II, line 1, column (d) or

schedule regardless of where the agency is

needed, and number each page. Use Part IV if

(e), and report any accruals of present value

located or operated.

additional space is needed for descriptions of

increments in future years.

particular column entries.

A domestic individual is a person,

including a foreign citizen, who lives or

resides in the United States (or a U.S.

possession) and not outside of the United

States (or a U.S. possession).

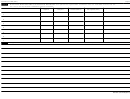

1

1 2

2 3

3 4

4