4

Schedule I (Form 990) (2017)

Page

Line 2. Add the number of recipient

Enter the details of each type of assistance

its fair market value. For marketable securities

organizations listed on Schedule I (Form 990),

to individuals on a separate line of Part III. If

registered and listed on a recognized

Part II, line 1, that (a) have been recognized by

there are more types of assistance than space

securities exchange, measure market value by

the Internal Revenue Service as exempt from

available, report the types of assistance on

the average of the highest and lowest quoted

federal income tax as described in section

duplicate copies of Part III. Use as many

selling prices or the average between the

501(c)(3); (b) are churches, including

duplicate copies as needed, and number each

bona fide bid and asked prices, on the date

synagogues, temples, and mosques; (c) are

page. Use Part IV if additional space is

the property is distributed to the grantee.

integrated auxiliaries of churches and

needed for descriptions of particular column

When fair market value cannot be readily

conventions or association of churches; or (d)

entries.

determined, use an appraised or estimated

are domestic governments. Enter the total.

value.

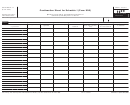

Column (a). Specify type(s) of assistance

Line 3. Add the number of recipient

Column (f). For noncash grants or assistance,

provided, or describe the purpose or use of

organizations listed on Schedule I (Form 990),

grant funds. Don’t use general terms such as

enter descriptions of property. List all that

Part II, line 1, that aren’t described on line 2.

charitable, educational, religious, or scientific.

apply. Examples of noncash assistance

This number should include both

Use more specific descriptions, such as

include medical supplies or equipment,

organizations that aren’t tax-exempt and

scholarships for students attending a

pharmaceuticals, blankets, and books or

organizations that are tax-exempt under

particular school; provision of books or other

other educational supplies.

section 501(c) but not section 501(c)(3).

educational supplies; food, clothing, and

If the organization checks

shelter for indigents, or direct cash assistance

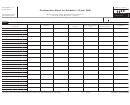

Part III. Grants and Other

“Accrual” on Form 990, Part XII,

to indigents; etc. In the case of specific

TIP

Assistance to Domestic

line 1; follows SFAS 116 (ASC

disaster assistance, include a description of

958) (see instructions for Form

Individuals

the type of assistance provided and identify

990, Part IX); and makes a grant during the

the disaster (for example, “Food, shelter, and

Complete Part III if the organization answered

tax year to be paid in future years to a

clothing for immediate relief for victims of

“Yes” on Form 990, Part IV, line 22. A “Yes”

domestic individual, it should report the

Colorado wildfires”).

response means that the organization

grant’s present value in Part III, column (c) or

Column (b). Enter the number of recipients

reported more than $5,000 on Form 990, Part

(d), and report any accruals of present value

for each type of assistance. If the organization

IX, line 2, column (A).

increments in future years.

is unable to determine the actual number,

Enter information for grants and other

provide an estimate of the number. Explain in

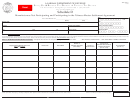

Part IV. Supplemental Information

assistance made to or for the benefit of

Part IV how the organization arrived at the

individual recipients. Don’t complete Part III

Use Part IV to provide narrative information

estimate.

for grants or assistance provided to

required in Part I, line 2, regarding monitoring

Column (c). Enter the aggregate dollar

individuals through another organization or

of funds, and in Part III, column (b), regarding

amount of cash grants for each type of grant

entity, unless the grant or assistance is

how the organization estimated the number of

or assistance. Cash grants include grants and

earmarked by the filing organization for the

recipients for each type of grant or

allocations paid by cash, check, money order,

benefit of one or more specific domestic

assistance. Also use Part IV to provide other

electronic fund or wire transfer, and other

individuals. Instead, complete Part II, earlier.

narrative explanations and descriptions, as

charges against funds on deposit at a

For example, report a payment to a hospital

needed. Identify the specific part and line(s)

financial institution.

designated to cover the medical expenses of

that the response supports. Part IV can be

particular domestic individuals in Part III and

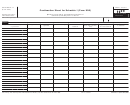

Columns (d) and (e). Enter the fair market

duplicated if more space is needed.

value of noncash property. Describe the

report a contribution to a hospital designated

to provide some service to the general public

method of valuation. Report property with a

or to unspecified domestic charity patients in

readily determinable market value (for

Part II.

example, market quotations for securities) at

1

1 2

2 3

3 4

4