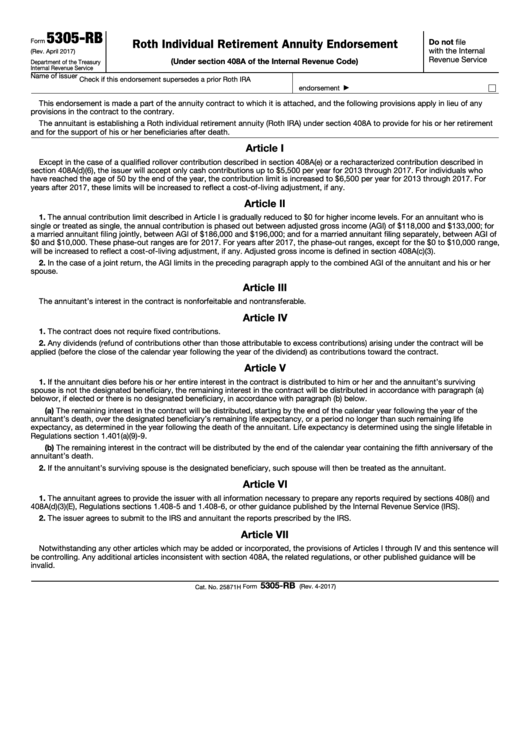

5305-RB

Roth Individual Retirement Annuity Endorsement

Form

Do not file

with the Internal

(Rev. April 2017)

Revenue Service

(Under section 408A of the Internal Revenue Code)

Department of the Treasury

Internal Revenue Service

Name of issuer

Check if this endorsement supersedes a prior Roth IRA

endorsement .

.

.

.

.

.

.

.

.

.

.

.

▶

This endorsement is made a part of the annuity contract to which it is attached, and the following provisions apply in lieu of any

provisions in the contract to the contrary.

The annuitant is establishing a Roth individual retirement annuity (Roth IRA) under section 408A to provide for his or her retirement

and for the support of his or her beneficiaries after death.

Article I

Except in the case of a qualified rollover contribution described in section 408A(e) or a recharacterized contribution described in

section 408A(d)(6), the issuer will accept only cash contributions up to $5,500 per year for 2013 through 2017. For individuals who

have reached the age of 50 by the end of the year, the contribution limit is increased to $6,500 per year for 2013 through 2017. For

years after 2017, these limits will be increased to reflect a cost-of-living adjustment, if any.

Article II

1. The annual contribution limit described in Article I is gradually reduced to $0 for higher income levels. For an annuitant who is

single or treated as single, the annual contribution is phased out between adjusted gross income (AGI) of $118,000 and $133,000; for

a married annuitant filing jointly, between AGI of $186,000 and $196,000; and for a married annuitant filing separately, between AGI of

$0 and $10,000. These phase-out ranges are for 2017. For years after 2017, the phase-out ranges, except for the $0 to $10,000 range,

will be increased to reflect a cost-of-living adjustment, if any. Adjusted gross income is defined in section 408A(c)(3).

2. In the case of a joint return, the AGI limits in the preceding paragraph apply to the combined AGI of the annuitant and his or her

spouse.

Article III

The annuitant’s interest in the contract is nonforfeitable and nontransferable.

Article IV

1. The contract does not require fixed contributions.

2. Any dividends (refund of contributions other than those attributable to excess contributions) arising under the contract will be

applied (before the close of the calendar year following the year of the dividend) as contributions toward the contract.

Article V

1. If the annuitant dies before his or her entire interest in the contract is distributed to him or her and the annuitant’s surviving

spouse is not the designated beneficiary, the remaining interest in the contract will be distributed in accordance with paragraph (a)

below or, if elected or there is no designated beneficiary, in accordance with paragraph (b) below.

(a) The remaining interest in the contract will be distributed, starting by the end of the calendar year following the year of the

annuitant’s death, over the designated beneficiary’s remaining life expectancy, or a period no longer than such remaining life

expectancy, as determined in the year following the death of the annuitant. Life expectancy is determined using the single life table in

Regulations section 1.401(a)(9)-9.

(b) The remaining interest in the contract will be distributed by the end of the calendar year containing the fifth anniversary of the

annuitant’s death.

2. If the annuitant’s surviving spouse is the designated beneficiary, such spouse will then be treated as the annuitant.

Article VI

1. The annuitant agrees to provide the issuer with all information necessary to prepare any reports required by sections 408(i) and

408A(d)(3)(E), Regulations sections 1.408-5 and 1.408-6, or other guidance published by the Internal Revenue Service (IRS).

2. The issuer agrees to submit to the IRS and annuitant the reports prescribed by the IRS.

Article VII

Notwithstanding any other articles which may be added or incorporated, the provisions of Articles I through IV and this sentence will

be controlling. Any additional articles inconsistent with section 408A, the related regulations, or other published guidance will be

invalid.

5305-RB

Form

(Rev. 4-2017)

Cat. No. 25871H

1

1 2

2