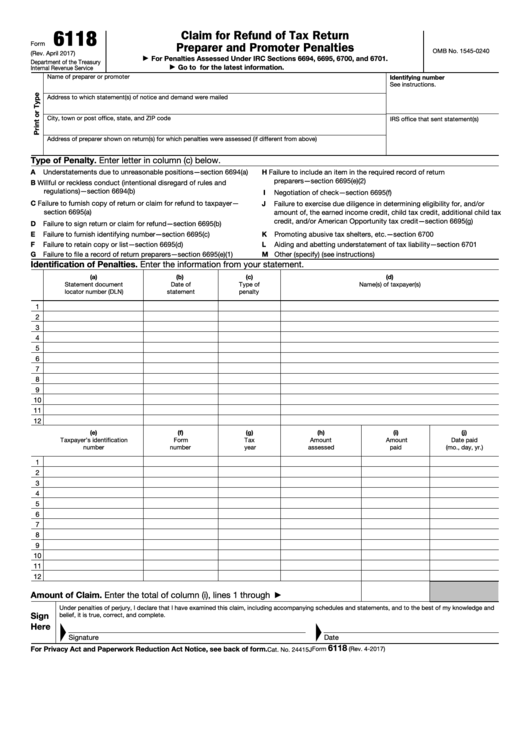

6118

Claim for Refund of Tax Return

Form

Preparer and Promoter Penalties

OMB No. 1545-0240

(Rev. April 2017)

For Penalties Assessed Under IRC Sections 6694, 6695, 6700, and 6701.

▶

Department of the Treasury

Go to for the latest information.

Internal Revenue Service

▶

Name of preparer or promoter

Identifying number

See instructions.

Address to which statement(s) of notice and demand were mailed

City, town or post office, state, and ZIP code

IRS office that sent statement(s)

Address of preparer shown on return(s) for which penalties were assessed (if different from above)

Type of Penalty. Enter letter in column (c) below.

A

Understatements due to unreasonable positions—section 6694(a)

H

Failure to include an item in the required record of return

preparers—section 6695(e)(2)

B

Willful or reckless conduct (intentional disregard of rules and

regulations)—section 6694(b)

I

Negotiation of check—section 6695(f)

C

Failure to furnish copy of return or claim for refund to taxpayer—

J

Failure to exercise due diligence in determining eligibility for, and/or

section 6695(a)

amount of, the earned income credit, child tax credit, additional child tax

credit, and/or American Opportunity tax credit—section 6695(g)

D

Failure to sign return or claim for refund—section 6695(b)

E

Failure to furnish identifying number—section 6695(c)

K

Promoting abusive tax shelters, etc.—section 6700

F

Failure to retain copy or list—section 6695(d)

L

Aiding and abetting understatement of tax liability—section 6701

G Failure to file a record of return preparers—section 6695(e)(1)

M Other (specify) (see instructions)

Identification of Penalties. Enter the information from your statement.

(a)

(b)

(c)

(d)

Statement document

Date of

Type of

Name(s) of taxpayer(s)

locator number (DLN)

statement

penalty

1

2

3

4

5

6

7

8

9

10

11

12

(e)

(f)

(g)

(h)

(i)

(j)

Taxpayer’s identification

Form

Tax

Amount

Amount

Date paid

number

number

year

assessed

paid

(mo., day, yr.)

1

2

3

4

5

6

7

8

9

10

11

12

Amount of Claim. Enter the total of column (i), lines 1 through 12 . . . . . .

▶

Under penalties of perjury, I declare that I have examined this claim, including accompanying schedules and statements, and to the best of my knowledge and

Sign

belief, it is true, correct, and complete.

Here

Signature

Date

6118

For Privacy Act and Paperwork Reduction Act Notice, see back of form.

Form

(Rev. 4-2017)

Cat. No. 24415J

1

1 2

2