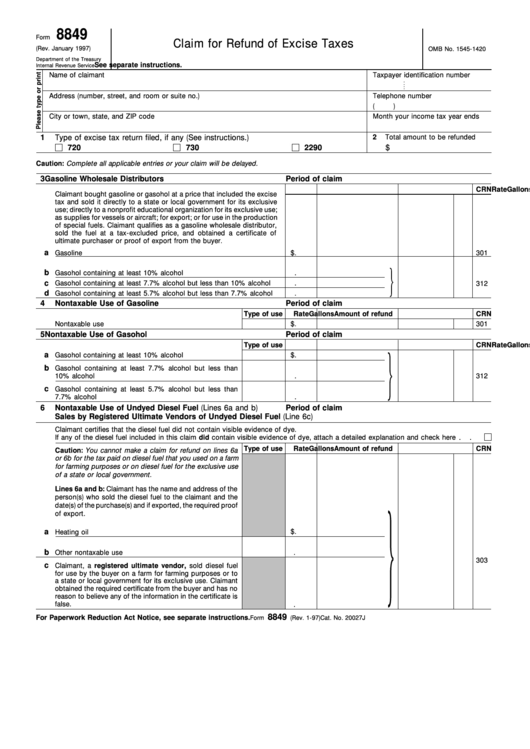

8849

Form

Claim for Refund of Excise Taxes

(Rev. January 1997)

OMB No. 1545-1420

Department of the Treasury

See separate instructions.

Internal Revenue Service

Name of claimant

Taxpayer identification number

Address (number, street, and room or suite no.)

Telephone number

(

)

City or town, state, and ZIP code

Month your income tax year ends

1

Type of excise tax return filed, if any (See instructions.)

2

Total amount to be refunded

720

730

2290

$

Caution: Complete all applicable entries or your claim will be delayed.

3

Gasoline Wholesale Distributors

Period of claim

Rate

Gallons

Amount of refund

CRN

Claimant bought gasoline or gasohol at a price that included the excise

tax and sold it directly to a state or local government for its exclusive

use; directly to a nonprofit educational organization for its exclusive use;

as supplies for vessels or aircraft; for export; or for use in the production

of special fuels. Claimant qualifies as a gasoline wholesale distributor,

sold the fuel at a tax-excluded price, and obtained a certificate of

ultimate purchaser or proof of export from the buyer.

a

Gasoline

$.

301

b

Gasohol containing at least 10% alcohol

.

c

Gasohol containing at least 7.7% alcohol but less than 10% alcohol

.

312

d

Gasohol containing at least 5.7% alcohol but less than 7.7% alcohol

.

4

Nontaxable Use of Gasoline

Period of claim

Type of use

Rate

Gallons

Amount of refund

CRN

Nontaxable use

$.

301

5

Nontaxable Use of Gasohol

Period of claim

Type of use

Rate

Gallons

Amount of refund

CRN

a

Gasohol containing at least 10% alcohol

$.

b

Gasohol containing at least 7.7% alcohol but less than

10% alcohol

.

312

c

Gasohol containing at least 5.7% alcohol but less than

7.7% alcohol

.

6

Nontaxable Use of Undyed Diesel Fuel (Lines 6a and b)

Period of claim

Sales by Registered Ultimate Vendors of Undyed Diesel Fuel (Line 6c)

Claimant certifies that the diesel fuel did not contain visible evidence of dye.

If any of the diesel fuel included in this claim did contain visible evidence of dye, attach a detailed explanation and check here

Type of use

Rate

Gallons

Amount of refund

CRN

Caution: You cannot make a claim for refund on lines 6a

or 6b for the tax paid on diesel fuel that you used on a farm

for farming purposes or on diesel fuel for the exclusive use

of a state or local government.

Lines 6a and b: Claimant has the name and address of the

person(s) who sold the diesel fuel to the claimant and the

date(s) of the purchase(s) and if exported, the required proof

of export.

a

$.

Heating oil

b

Other nontaxable use

.

303

c

Claimant, a registered ultimate vendor, sold diesel fuel

for use by the buyer on a farm for farming purposes or to

a state or local government for its exclusive use. Claimant

obtained the required certificate from the buyer and has no

reason to believe any of the information in the certificate is

false.

.

8849

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 20027J

Form

(Rev. 1-97)

1

1 2

2