4

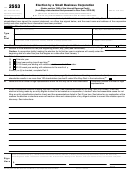

Form 2553 (Rev. 12-2017)

Page

Name

Employer identification number

Part III

Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)* Note: If you are making more than

one QSST election, use additional copies of page 4.

Income beneficiary’s name and address

Social security number

Trust’s name and address

Employer identification number

Date on which stock of the corporation was transferred to the trust (month, day, year) .

.

.

.

.

.

.

.

▶

In order for the trust named above to be a QSST and thus a qualifying shareholder of the S corporation for which this Form 2553 is

filed, I hereby make the election under section 1361(d)(2). Under penalties of perjury, I certify that the trust meets the definitional

requirements of section 1361(d)(3) and that all other information provided in Part III is true, correct, and complete.

Signature of income beneficiary or signature and title of legal representative or other qualified person making the election

Date

* Use Part III to make the QSST election only if stock of the corporation has been transferred to the trust on or before the date on

which the corporation makes its election to be an S corporation. The QSST election must be made and filed separately if stock of the

corporation is transferred to the trust after the date on which the corporation makes the S election.

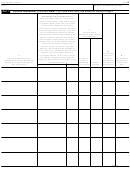

Part IV

Late Corporate Classification Election Representations (see instructions)

If a late entity classification election was intended to be effective on the same date that the S corporation election was intended to be

effective, relief for a late S corporation election must also include the following representations.

1

The requesting entity is an eligible entity as defined in Regulations section 301.7701-3(a);

2

The requesting entity intended to be classified as a corporation as of the effective date of the S corporation status;

3

The requesting entity fails to qualify as a corporation solely because Form 8832, Entity Classification Election, was not timely

filed under Regulations section 301.7701-3(c)(1)(i), or Form 8832 was not deemed to have been filed under Regulations section

301.7701-3(c)(1)(v)(C);

4

The requesting entity fails to qualify as an S corporation on the effective date of the S corporation status solely because the

S corporation election was not timely filed pursuant to section 1362(b); and

5a

The requesting entity timely filed all required federal tax returns and information returns consistent with its requested

classification as an S corporation for all of the years the entity intended to be an S corporation and no inconsistent tax or

information returns have been filed by or with respect to the entity during any of the tax years, or

b

The requesting entity has not filed a federal tax or information return for the first year in which the election was intended to be

effective because the due date has not passed for that year’s federal tax or information return.

2553

Form

(Rev. 12-2017)

1

1 2

2 3

3 4

4