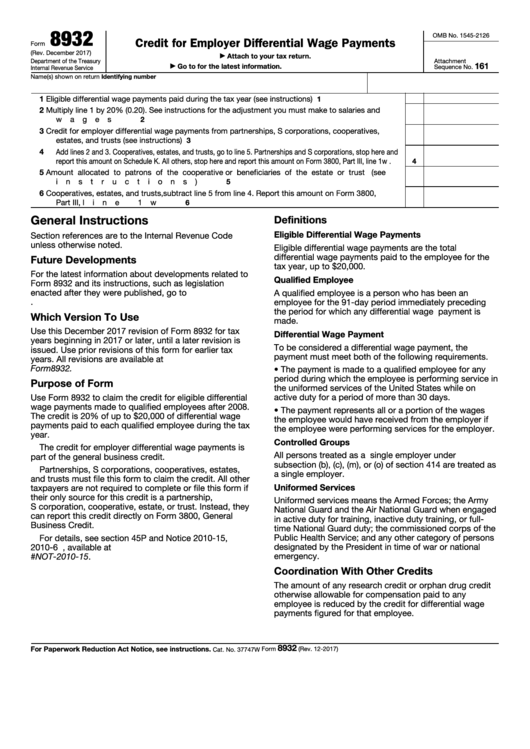

8932

OMB No. 1545-2126

Credit for Employer Differential Wage Payments

Form

(Rev. December 2017)

Attach to your tax return.

▶

Department of the Treasury

Attachment

161

Go to for the latest information.

Sequence No.

▶

Internal Revenue Service

Name(s) shown on return

Identifying number

1

Eligible differential wage payments paid during the tax year (see instructions)

.

.

.

.

.

.

.

1

2

Multiply line 1 by 20% (0.20). See instructions for the adjustment you must make to salaries and

wages .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

Credit for employer differential wage payments from partnerships, S corporations, cooperatives,

estates, and trusts (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Add lines 2 and 3. Cooperatives, estates, and trusts, go to line 5. Partnerships and S corporations, stop here and

report this amount on Schedule K. All others, stop here and report this amount on Form 3800, Part III, line 1w .

4

5

Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

(see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

Cooperatives, estates, and trusts, subtract line 5 from line 4. Report this amount on Form 3800,

Part III, line 1w .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

General Instructions

Definitions

Eligible Differential Wage Payments

Section references are to the Internal Revenue Code

unless otherwise noted.

Eligible differential wage payments are the total

differential wage payments paid to the employee for the

Future Developments

tax year, up to $20,000.

For the latest information about developments related to

Qualified Employee

Form 8932 and its instructions, such as legislation

enacted after they were published, go to

A qualified employee is a person who has been an

.

employee for the 91-day period immediately preceding

the period for which any differential wage payment is

Which Version To Use

made.

Use this December 2017 revision of Form 8932 for tax

Differential Wage Payment

years beginning in 2017 or later, until a later revision is

To be considered a differential wage payment, the

issued. Use prior revisions of this form for earlier tax

payment must meet both of the following requirements.

years. All revisions are available at

Form8932.

• The payment is made to a qualified employee for any

period during which the employee is performing service in

Purpose of Form

the uniformed services of the United States while on

Use Form 8932 to claim the credit for eligible differential

active duty for a period of more than 30 days.

wage payments made to qualified employees after 2008.

• The payment represents all or a portion of the wages

The credit is 20% of up to $20,000 of differential wage

the employee would have received from the employer if

payments paid to each qualified employee during the tax

the employee were performing services for the employer.

year.

Controlled Groups

The credit for employer differential wage payments is

All persons treated as a single employer under

part of the general business credit.

subsection (b), (c), (m), or (o) of section 414 are treated as

Partnerships, S corporations, cooperatives, estates,

a single employer.

and trusts must file this form to claim the credit. All other

Uniformed Services

taxpayers are not required to complete or file this form if

their only source for this credit is a partnership,

Uniformed services means the Armed Forces; the Army

S corporation, cooperative, estate, or trust. Instead, they

National Guard and the Air National Guard when engaged

can report this credit directly on Form 3800, General

in active duty for training, inactive duty training, or full-

Business Credit.

time National Guard duty; the commissioned corps of the

Public Health Service; and any other category of persons

For details, see section 45P and Notice 2010-15,

designated by the President in time of war or national

2010-6 I.R.B. 390, available at

emergency.

irb/2010-06_IRB#NOT-2010-15.

Coordination With Other Credits

The amount of any research credit or orphan drug credit

otherwise allowable for compensation paid to any

employee is reduced by the credit for differential wage

payments figured for that employee.

8932

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2017)

Cat. No. 37747W

1

1 2

2