2

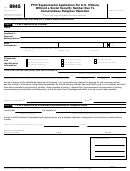

Form 8945 (Rev. 10-2017)

Page

General Instructions

group as “Unaffiliated Mennonite Churches,” or “Eastern

Pennsylvania Mennonite Church,” etc., as your religious group,

Section references are to the Internal Revenue Code unless

and the congregation as “Antrim Mennonite Church

otherwise noted.

(Anabaptist),” or “Bethel Mennonite Church (Mennonite),” on the

second line.

Future Developments

How To Apply

For the latest information about developments related to Form

8945 and its instructions, such as legislation enacted after they

Online. Go to the webpage for information.

were published, go to

During the PTIN application process, you will be prompted to

complete and mail Form 8945 and supporting documents to the

Purpose of Form

address noted below.

Form 8945 is used by U.S. citizens who are members of certain

Applying by mail. Complete both Form W-12 and Form 8945.

recognized religious groups (defined below) that want to

• Send both forms and the supporting documents to the

prepare tax returns for compensation. All tax return preparers

following address.

must obtain a preparer tax identification number (PTIN) to

IRS Tax Professional PTIN Processing Center

prepare tax returns for compensation. Generally, the IRS

1605 George Dieter PMB 678

requires an individual to provide a social security number (SSN)

El Paso, TX 79936

to get a PTIN. Because members of certain religious groups

have a conscientious objection to obtaining an SSN, Form 8945

Allow 4 to 6 weeks for the IRS to process your application.

must be filed by these individuals to establish their identity, U.S.

Submission of Form 8945. Submit the following.

citizenship, and status as members of a recognized religious

group.

1. Your completed Form 8945.

You must have a PTIN to prepare a tax return for

2. The original documents, certified copies, or notarized

compensation.

copies of documents that substantiate the information provided

TIP

on Form 8945. The supporting documentation must be

consistent with the information provided on Form 8945. For

SSNs. Do not complete Form 8945 if you have an SSN or are

example, the name must be the same as on Form 8945, line 1

not a member of a religious group that has a conscientious

(or in the case of a civil birth certificate, line 3); and the date of

objection to obtaining an SSN. If you have an application for an

birth must be the same as on Form 8945, line 3.

SSN pending, do not file Form 8945.

To avoid any loss of your documents, it is suggested

If you already have an SSN, enter the SSN when you apply for

you do not submit the original documentation.

TIP

your PTIN using Form W-12, IRS Paid Preparer Tax Identification

Number (PTIN) Application and Renewal.

You can submit original documents, or certified or notarized

To get an SSN, see Form SS-5, Application for a Social

copies. A certified document is one that the original issuing

Security Card. To get Form SS-5 or to find out if you are eligible

agency provides and certifies as an exact copy of the original

to get an SSN, go to or contact a Social Security

document and contains an official seal from the issuing agency.

Administration (SSA) office.

All certifications must stay attached to the copies of the

Telephone help. If you have questions about completing this

documents when they’re sent to the IRS. Certified documents

form, the status of your application, or the return of your original

have a stamp and/or an ink seal (may or may not be raised). Any

documents submitted with this form, you may call the following

document certified by a foreign official must be issued by the

phone numbers. If calling from the United States, call

agency or official custodian of the original record. The foreign

1-877-613-PTIN (7846). For TTY/TDD assistance, call

certification must clearly certify that each document is a true

1-877-613-3686. If calling internationally, call +1 915-342-5655

copy of the original. All certifications must stay attached to the

(not a toll-free number). Telephone help is generally available

copies of the documents when they are sent to the IRS.

Monday through Friday from 8:00 a.m. to 5:00 p.m. Central time.

A notarized document is one that has been notarized by a

Who May Apply

U.S. notary public, U.S. government military officer (JAG

Officer), U.S. State Department, U.S. Consul/Embassy

You may apply if you are a member of, and follow the teachings

Employee, or a foreign notary legally authorized within his or her

of, a recognized religious group (as defined below).

local jurisdiction to certify that each document is a true copy of

You are not eligible to file Form 8945 as part of the process of

the original. To do this, the notary must see the valid, unaltered,

obtaining a PTIN if you received social security benefits or

original documents and verify that the copies conform to the

original. All of the notarized copies must bear the mark (stamp,

payments, or if anyone else received these benefits or payments

signature, etc.) of the notary. Notarized documents may or may

based on your wages or self-employment income.

not have a signature but will have a stamp and usually a raised

Recognized religious group. A recognized religious group

seal.

must meet the following requirements.

Original documents you submit will be returned to

• It is conscientiously opposed to its members applying for and

you at the mailing address shown on your Form

TIP

receiving SSNs.

8945. You do not need to provide a return envelope.

• It has existed continuously since December 31, 1950.

If your original documents are not returned within 60

days, you can call us at the phone numbers provided earlier

Certification. In order to complete the certification portion

under Telephone help. Copies of documents will not be

above the signature of applicant, you need to enter your

returned.

religious group (on the first line) followed by the religious district

or congregation (on the second line). For example, if you enter

“Old Order Amish” as your religious group, then you would enter

“Conewango Valley North District,” “Conewango Valley West

District,” etc., on the second line as the district. However, if you

are Anabaptist or Mennonite, enter the name of your religious

1

1 2

2 3

3