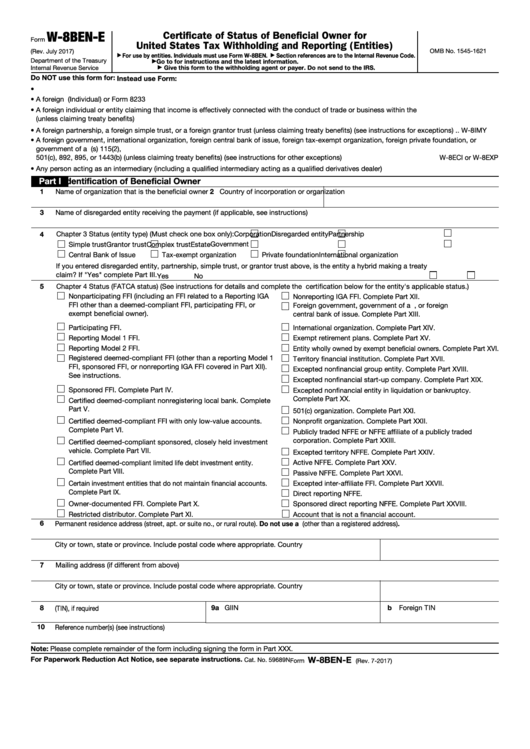

W-8BEN-E

Certificate of Status of Beneficial Owner for

Form

United States Tax Withholding and Reporting (Entities)

OMB No. 1545-1621

(Rev. July 2017)

For use by entities. Individuals must use Form W-8BEN.

Section references are to the Internal Revenue Code.

▶

▶

Department of the Treasury

Go to for instructions and the latest information.

▶

Internal Revenue Service

Give this form to the withholding agent or payer. Do not send to the IRS.

▶

Do NOT use this form for:

Instead use Form:

• U.S. entity or U.S. citizen or resident .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. W-9

• A foreign individual

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. W-8BEN (Individual) or Form 8233

• A foreign individual or entity claiming that income is effectively connected with the conduct of trade or business within the U.S.

(unless claiming treaty benefits) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. W-8ECI

• A foreign partnership, a foreign simple trust, or a foreign grantor trust (unless claiming treaty benefits) (see instructions for exceptions)

.

. W-8IMY

• A foreign government, international organization, foreign central bank of issue, foreign tax-exempt organization, foreign private foundation, or

government of a U.S. possession claiming that income is effectively connected U.S. income or that is claiming the applicability of section(s) 115(2),

501(c), 892, 895, or 1443(b) (unless claiming treaty benefits) (see instructions for other exceptions) .

.

.

.

.

.

.

.

.

W-8ECI or W-8EXP

• Any person acting as an intermediary (including a qualified intermediary acting as a qualified derivatives dealer) .

.

.

.

.

.

.

.

. W-8IMY

Part I

Identification of Beneficial Owner

1

Name of organization that is the beneficial owner

2 Country of incorporation or organization

3

Name of disregarded entity receiving the payment (if applicable, see instructions)

4

Chapter 3 Status (entity type) (Must check one box only):

Corporation

Disregarded entity

Partnership

Government

Simple trust

Grantor trust

Complex trust

Estate

Central Bank of Issue

Tax-exempt organization

Private foundation

International organization

If you entered disregarded entity, partnership, simple trust, or grantor trust above, is the entity a hybrid making a treaty

claim? If "Yes" complete Part III.

Yes

No

5

Chapter 4 Status (FATCA status) (See instructions for details and complete the certification below for the entity's applicable status.)

Nonparticipating FFI (including an FFI related to a Reporting IGA

Nonreporting IGA FFI. Complete Part XII.

FFI other than a deemed-compliant FFI, participating FFI, or

Foreign government, government of a U.S. possession, or foreign

exempt beneficial owner).

central bank of issue. Complete Part XIII.

Participating FFI.

International organization. Complete Part XIV.

Reporting Model 1 FFI.

Exempt retirement plans. Complete Part XV.

Reporting Model 2 FFI.

Entity wholly owned by exempt beneficial owners. Complete Part XVI.

Registered deemed-compliant FFI (other than a reporting Model 1

Territory financial institution. Complete Part XVII.

FFI, sponsored FFI, or nonreporting IGA FFI covered in Part XII).

Excepted nonfinancial group entity. Complete Part XVIII.

See instructions.

Excepted nonfinancial start-up company. Complete Part XIX.

Sponsored FFI. Complete Part IV.

Excepted nonfinancial entity in liquidation or bankruptcy.

Complete Part XX.

Certified deemed-compliant nonregistering local bank. Complete

Part V.

501(c) organization. Complete Part XXI.

Certified deemed-compliant FFI with only low-value accounts.

Nonprofit organization. Complete Part XXII.

Complete Part VI.

Publicly traded NFFE or NFFE affiliate of a publicly traded

corporation. Complete Part XXIII.

Certified deemed-compliant sponsored, closely held investment

vehicle. Complete Part VII.

Excepted territory NFFE. Complete Part XXIV.

Active NFFE. Complete Part XXV.

Certified deemed-compliant limited life debt investment entity.

Complete Part VIII.

Passive NFFE. Complete Part XXVI.

Certain investment entities that do not maintain financial accounts.

Excepted inter-affiliate FFI. Complete Part XXVII.

Complete Part IX.

Direct reporting NFFE.

Owner-documented FFI. Complete Part X.

Sponsored direct reporting NFFE. Complete Part XXVIII.

Restricted distributor. Complete Part XI.

Account that is not a financial account.

6

Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address (other than a registered address).

City or town, state or province. Include postal code where appropriate.

Country

7

Mailing address (if different from above)

City or town, state or province. Include postal code where appropriate.

Country

9a GIIN

b Foreign TIN

8

U.S. taxpayer identification number (TIN), if required

10

Reference number(s) (see instructions)

Note: Please complete remainder of the form including signing the form in Part XXX.

W-8BEN-E

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 59689N

Form

(Rev. 7-2017)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8