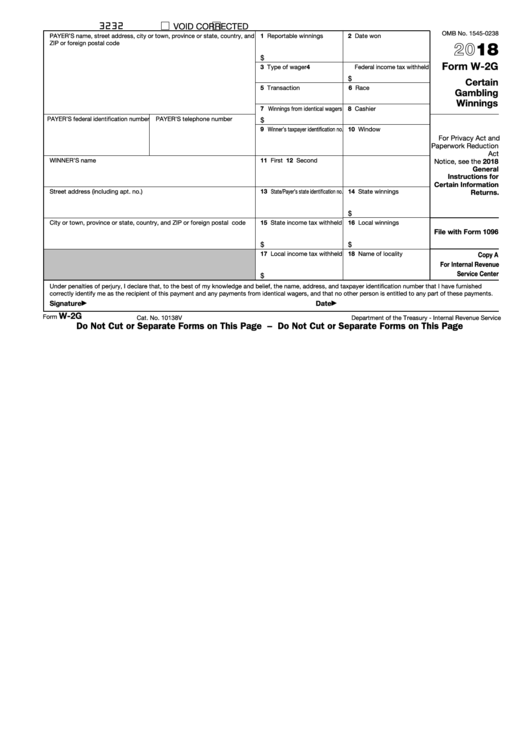

What Is a W-2G Form?

Form W-2G, Certain Gambling Winnings is used to report profit from gambling. Gambling income includes winnings from horse racing, dog racing, jai alai, lotteries, keno, bingo, slot machines, sweepstakes, wagering pools, poker tournaments, etc.

If your gambling income is high enough, the payer must provide Form W-2G to you and to the IRS, reporting the amount of your winnings. You will receive a copy of Form W-2G if you win:

- $600 or more from gambling and the payout is at least 300 times the amount of the wager (winnings from bingo, keno, and slot machines are not subject to this rule);

- $1200 or more in gambling winnings from bingo or slot machines;

- $1500 or more in proceeds from keno;

- Any gambling winnings subject to federal income tax withholding.

All gambling winnings are fully taxable and must be reported to the IRS. Penalties can apply if income and deductible expenses are not reported by businesses and individuals in full. The latest fillable version of Form W-2G is available for download below.

Who Needs to File W-2G Form?

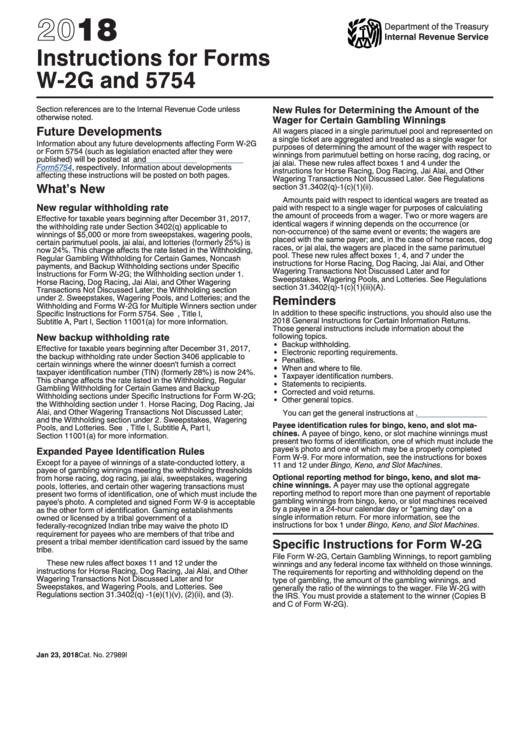

The requirements for reporting and withholding winnings depend on:

- the type of gambling;

- the amount of money won;

- the ratio of the winnings to the wager.

The full yearly amount of your gambling winnings must be reported on line 21 of IRS Form 1040 and cannot be reported on Form 1040A or 1040EZ. This rule is universal and applies regardless of whether you receive a Form W-2G or any other reporting form.

You must keep an accurate record of all winnings and losses and keep other documentation to help you figure out the amount to report to the IRS. You can prove your winnings and losses through:

- Form W-2G;

- Form 5754;

- Wagering tickets;

- Canceled or substitute checks;

- Credit records;

- Bank withdrawals;

- Statements of actual winnings or payment slips provided by the payer of the gambling establishment.

Form W-2G Due Dates

Form W-2G is required to be mailed by the payer to the recipient by January 31 and sent to the IRS by February 28 or March 31 if filed electronically.

Form W-2g Templates