Form 3180w - Order Of Discharge

ADVERTISEMENT

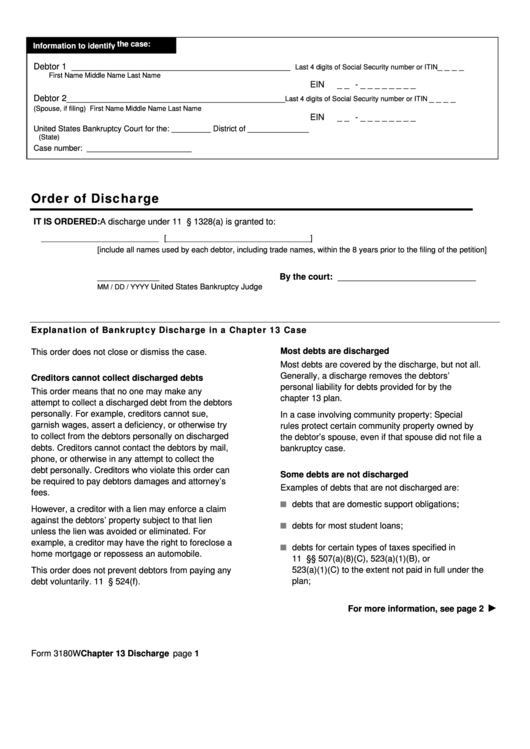

Information to identify the case:

Debtor 1

______________________________________________

_ _ _ _

Last 4 digits of Social Security number or ITIN

First Name

Middle Name

Last Name

EIN

_ _ - _ _ _ _ _ _ _ _

Debtor 2

______________________________________________

_ _ _ _

Last 4 digits of Social Security number or ITIN

(Spouse, if filing) First Name

Middle Name

Last Name

EIN

_ _ - _ _ _ _ _ _ _ _

United States Bankruptcy Court for the: _________ District of ______________

(State)

Case number: ________________________

Order of Discharge

IT IS ORDERED: A discharge under 11 U.S.C. § 1328(a) is granted to:

___________________________

[_________________________________]

[include all names used by each debtor, including trade names, within the 8 years prior to the filing of the petition]

_____________

By the court: _____________________________

United States Bankruptcy Judge

MM / DD / YYYY

Explanation of Bankruptcy Discharge in a Chapter 13 Case

Most debts are discharged

This order does not close or dismiss the case.

Most debts are covered by the discharge, but not all.

Generally, a discharge removes the debtors’

Creditors cannot collect discharged debts

personal liability for debts provided for by the

This order means that no one may make any

chapter 13 plan.

attempt to collect a discharged debt from the debtors

personally. For example, creditors cannot sue,

In a case involving community property: Special

garnish wages, assert a deficiency, or otherwise try

rules protect certain community property owned by

to collect from the debtors personally on discharged

the debtor’s spouse, even if that spouse did not file a

debts. Creditors cannot contact the debtors by mail,

bankruptcy case.

phone, or otherwise in any attempt to collect the

debt personally. Creditors who violate this order can

Some debts are not discharged

be required to pay debtors damages and attorney’s

Examples of debts that are not discharged are:

fees.

debts that are domestic support obligations;

However, a creditor with a lien may enforce a claim

against the debtors’ property subject to that lien

debts for most student loans;

unless the lien was avoided or eliminated. For

example, a creditor may have the right to foreclose a

debts for certain types of taxes specified in

home mortgage or repossess an automobile.

11 U.S.C. §§ 507(a)(8)(C), 523(a)(1)(B), or

This order does not prevent debtors from paying any

523(a)(1)(C) to the extent not paid in full under the

plan;

debt voluntarily. 11 U.S.C. § 524(f).

►

For more information, see page 2

Form 3180W

Chapter 13 Discharge

page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2